The Hidden Cost of Choosing Family: Are You Preparing Your Children for a Workforce That Doesn't Yet Exist?

Every high-earning professional in Singapore knows this uncomfortable truth: we're caught in an impossible bind. On one side, the relentless pull of caregiving—elderly parents requiring support, children needing presence. On the other, the very real financial penalties of stepping away. But here's what keeps me up at night: whilst we're wrestling with this present-day dilemma, we're overlooking a more existential threat to our children's futures.

The World Economic Forum predicts that 65% of children entering primary school today will work in jobs that don't yet exist. The question isn't just whether you can afford to step back. It's whether you're adequately preparing your child to thrive in—or be exploited by—a workforce none of us can fully envision.

The Sandwich Generation's Silent Tax

Let me paint you a picture using real numbers. Singapore is home to more than 210,000 caregivers navigating the dual burden of supporting aging parents whilst raising children. By 2030, one in four Singaporeans will be aged 65 and above. If you're a professional in your 40s, you're likely already feeling the squeeze.

Sarah Wong, a health tech leader and podcast host, articulates what many won't admit: "I think the biggest worry would be whether I would lose everything that I've spent so much time and worked so hard building not knowing whether I would regret the decision. Caregiving is such a invisible role and it gets lonely sometimes." (Wise and Shine 144, I Left My Job to Care for My Family - Was It Worth It?)

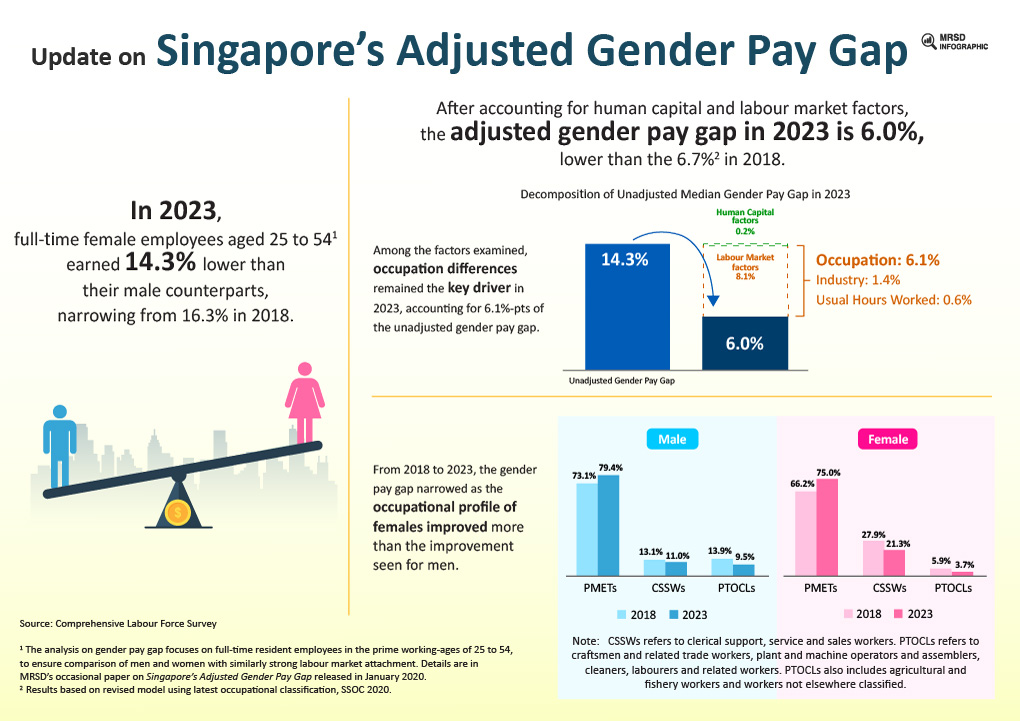

The financial mathematics are brutal. Singapore's adjusted gender pay gap stands at 14.3% as of 2023—meaning full-time female employees aged 25 to 54 earn nearly $15 less for every $100 their male counterparts earn. Ministry of Manpower This gap widens catastrophically for those taking career breaks.

Consider this: every year away from work doesn't just mean lost income. It means:

- Reduced CPF contributions compounding over decades

- Diminished promotion prospects upon return

- Skills obsolescence in rapidly evolving industries

- Network erosion in relationship-driven economies

- Confidence attrition that's difficult to quantify but devastatingly real

Research shows women taking career breaks for caregiving see not only immediate income loss but also face long-term impacts on retirement savings. A study highlighted by Development Asia notes that career breaks to care for family hold back women's corporate advancement and significantly affect retirement planning.

Some 63% of Singaporean women have either taken a career break or considered one, according to surveys cited by Her World. Yet we rarely discuss the invisible cost: the financial socialisation our children miss whilst we're managing this trade-off.

Financial Socialisation: The Skillset Schools Aren't Teaching

Here's the uncomfortable reality: whilst Singapore's education system excels at producing technically competent graduates, it's failing at preparing children for the financial and psychological complexity of tomorrow's workforce.

The World Economic Forum's research is stark: "By one popular estimate, 65% of children entering primary school today will ultimately end up working in completely new job types that don't yet exist." World Economic Forum By 2027, this prediction crystallises into a workforce unrecognisable from today's landscape.

So what skills will matter? Not just technical competencies—those will evolve too rapidly. The differentiator will be financial resilience, adaptability, and the psychological toolkit to navigate uncertainty. Yet how many of us are actively teaching our children:

- How to evaluate and pivot between multiple income streams (portfolio careers)?

- The psychology of money and delayed gratification?

- How to assess financial risk in gig economies and contract work?

- The relationship between work identity and self-worth when jobs become fluid?

Financial literacy programmes for children in Singapore exist, but they focus primarily on budgeting and saving—20th-century skills for a 21st-century problem. What children need is financial socialisation: understanding the trauma, education, and accumulation patterns that will define their economic futures.

The Price of Tomorrow: Beyond Today's Trade-offs

This October, Singapore is hosting The Price of Tomorrow: A Financial Wellness Festival, presented by OCBC in collaboration with The Financial Coconut and RICE Media. One particularly relevant session focuses on "Financial Socialisation: Trauma, Education and Accumulation for Your Child"—directly addressing the question every parent must ask themselves: "Has one fully prepared their child for the future workforce or will your child enter the future workforce vulnerable?"

This isn't abstract philosophising. When professionals like Cheryl—a former corporate marketer who took a five-month career break—describe their journey, they're navigating uncharted territory. She's now building skills in content creation, live-streaming for e-commerce, and community building on LinkedIn. These aren't traditional career pivots; they're demonstrations of portfolio career thinking that our children desperately need to observe and internalise.

As Sarah notes from her interviews with other mothers who've taken career breaks: "A lot of it is reframing, right? Like instead of seeing it as okay, this is a financial loss. Yes, it will be a financial loss, but can you think of it as an investment into yourself for your future self." (11:06-11:25, W&S 144)

This reframe is precisely what financial socialisation looks like in practice. Children who witness parents navigating career transitions with intentionality, who see portfolio careers being built, who understand that setbacks are investments—these are the children who'll thrive when 65% of their peers are scrambling in job markets that don't yet exist.

The Risk Mitigation Strategy High Earners Need

Let's be clear: We're not suggesting everyone should take career breaks, nor that staying in the workforce is wrong. What we are arguing is that both choices require deliberate financial socialisation strategies for your children—and most professionals are doing neither effectively.

Here's your risk mitigation framework:

1. Build Your Career Pause Fund (Even If You Never Use It)

The conventional wisdom suggests six months' emergency funds. For professionals considering caregiving responsibilities, experts like those featured in MoneyOwl's guide recommend extending this to 18-24 months. But here's the strategic twist: involve your children in understanding this planning.

Don't hide financial stress. Age-appropriately, show them how you're building buffers, how you evaluate trade-offs, how you plan for uncertainty. This is financial socialisation in action.

2. Model Portfolio Career Thinking—Whether You Have One or Not

From 1 April 2025, Singapore's Workforce Singapore enhanced Career Conversion Programmes specifically support reskilling and jobs with flexible loads. NTUC The professional landscape is shifting toward portfolio careers—multiple income streams, fractional work, gig economy engagement.

Sarah's journey exemplifies this: "My main bulk is my serious work, the corporate work that I do. So I'm head of sales in a spin out from NUHS and the other pieces are actually so funny because I went for a like a finance seminar where I learned how to do some kind of investment tradings... So that's another thing that I like learning as well." (30:20-30:52, W&S 144)

Even if you maintain traditional employment, discuss with your children how work is changing, show them how professionals diversify, explain why adaptability matters more than job titles.

3. Leverage Networks as Insurance

One critical insight from those who've successfully returned to work after career breaks? Maintained connections.

As one participant in the W&S episode observes: "I think one of the things that you did well was to continue to have that communication with your manager so that you knew what was going on with the company. It's not like you just, you know, went away and were, you know, MIA for a long time, right? That's why you could still be relevant when the opportunity presented itself." (00:18-00:37, W&S 144)

Teach your children that professional networks aren't just LinkedIn connections—they're strategic insurance policies for workforce volatility.

4. Reframe Career Breaks as Value-Additive, Not Subtractive

Singapore's Tripartite Guidelines on Flexible Work Arrangements, formalised from December 2024, signal cultural shifts toward valuing non-traditional career paths. When speaking about career breaks to potential employers, Sarah emphasises: "Put it as a additive rather than a subtractive in your career journey. You want to own your story and tell them that yes, you took this break for this long period of time, but this is it wasn't a break in the way that I did nothing. I did all these great things and this is what I created." (35:18-35:45, W&S 144)

This isn't spin—it's reality. Caregiving develops project management, emotional intelligence, resource optimisation, and crisis management. Skills that will remain valuable regardless of which 65% of future jobs materialise.

5. Actively Participate in Financial Socialisation Events

This is where events like The Price of Tomorrow become strategically important. They're not just educational—they're demonstrations to your children that financial literacy, workforce preparation, and long-term thinking are priorities worth investing time in.

The specific session on Financial Socialisation directly addresses trauma (financial anxiety children absorb), education (the frameworks they need), and accumulation (how to build wealth in uncertain futures). Attending with older children? Even better. Let them see you investing in knowledge.

The Question You Can't Avoid

Cheryl, reflecting on her decision to step back from corporate marketing, shares: "I think there's still this stigma that once we have taken a career break, we are giving up everything, we're taking a backseat. But that's not true because I mean for for everyone else out there, people take breaks for valid reasons. And more often they actually come back stronger with fresher perspective. They are more focused. They are just more resilient." (37:21-37:56, W&S 144)

She continues with perhaps the most critical insight: "I think it's important to know that it's not about how fast we move but how intentionally we move forward." (38:40-38:56, W&S 144)

This is the paradigm shift Singapore's high earners need to embrace—and model for their children. Speed isn't the metric. Intentionality is.

Because here's what we know with certainty:

- The workforce our children will enter doesn't yet exist

- Traditional career paths are disintegrating

- Financial resilience will trump job security

- Adaptability will be the ultimate competitive advantage

And here's what we don't know:

- Which specific jobs will emerge

- Which industries will be automated away

- What economic crises will reshape employment

- How AI will redistribute economic value

In this environment, the biggest threat isn't taking a career break. It's failing to prepare the next generation for radical uncertainty whilst we're consumed by present-day trade-offs.

Your Move

If you're a high-earning professional in Singapore reading this, you're likely already wrestling with these tensions. Perhaps you're in the sandwich generation, supporting parents whilst raising children. Perhaps you've taken a career break and worry about returning. Perhaps you're considering one and terrified of the financial implications.

But here's what we want you to sit with: whilst you're managing these very real present-day challenges, what are your children learning about financial resilience, workforce adaptability, and economic agency?

Because whether you take a career break or power through at full speed, whether you achieve the promotion or build a portfolio career, the question that will define your children's futures isn't about your choices. It's about what they're internalising from your choices.

The Price of Tomorrow isn't just about financial wellness festivals or educational sessions. It's the question that keeps every thoughtful parent awake: Have I fully prepared my child for the future workforce, or will they be at its mercy?

The workforce that doesn't yet exist? It's coming. Ready or not.

The only question is: will your children be amongst the 65% who thrive, or the 35% still clinging to job categories that vanished whilst they weren't looking?

About the Events:

- Financial Socialisation: Trauma, Education and Accumulation for Your Child - A focused session exploring how to prepare the next generation for economic uncertainty

- OCBC Presents — The Price of Tomorrow: A Financial Wellness Festival - A comprehensive exploration of financial wellness, career transitions, and future-proofing presented by OCBC with The Financial Coconut and RICE Media

Let us know what you think about this topic, and what do you want to hear next.

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

References:

- Ministry of Manpower, "Infographic: Update on Singapore's Adjusted Gender Pay Gap"

- NTUC, "Challenges faced by caregivers in Singapore and how NTUC provides support"

- Her World, "How to return to work after taking a long career break"

- Development Asia, "Why Women Pay a High Price for Unpaid Care Work"

- World Economic Forum, "The Future of Jobs - Executive Summary"

- World Economic Forum, "From classroom to career: Building a future-ready global workforce"

- MoneyOwl, "Considering a career break? Here's how you can plan for it"

- Ministry of Social and Family Development, "Caregiving Another Chapter in a Journey and Snuffing Out Burnout"

- Jupiter Recruitment, "Flexible Working Arrangements (FWA) for 2025 - What employers need to know"

- QuickHR, "Flexible Work Arrangements in Singapore: What Employers Need to Know"

- YouTube, "I Left My Job to Care for My Family - Was It Worth It?"

-3.png?width=50&name=Square%20(2)-3.png)

-career-conversion-programmes-(ccp)-for-individuals-(2)-career-conversion-programmes-(ccp)-for-employers.jpg?sfvrsn=8b477519_0)

-2.png?height=200&name=2024%20website%20assets%20(1)-2.png)

Let us know what you think of this post