The 3 Conversations About Money You Aren't Having (But Should Be)

We talk about money constantly—property prices, stock portfolios, salary benchmarks, the latest insurance products. Yet beneath this veneer of financial sophistication, there are three critical conversations most Singaporeans aren't having at all. Not with their partners, not with their ageing parents, not with their children, and often, not even with themselves.

These aren't technical discussions about asset allocation or tax optimisation. They're harder, messier, more uncomfortable conversations that sit at the intersection of money, identity, psychology, and family obligation. And for high-earning professionals—who ostensibly "have it sorted"—avoiding these conversations isn't just leaving money on the table. It's leaving wellbeing, security, and generational wisdom unclaimed.

This November, The Financial Coconut, in partnership with OCBC and RICE Media, is creating space for precisely these conversations through The Price of Tomorrow: A Financial Wellness Festival. Across three pivotal events—exploring:

- Millennial caregiving realities (30 October),

- Financial trauma and childhood money socialisation (13 November), and a

- Two-day festival (29-30 November)—the series directly addresses what we've been avoiding.

Let's examine the three money conversations you aren't having, why they matter more than your portfolio returns, and what happens when we finally break the silence.

Conversation 1: Care vs Cash—The Sandwich Generation Reckoning

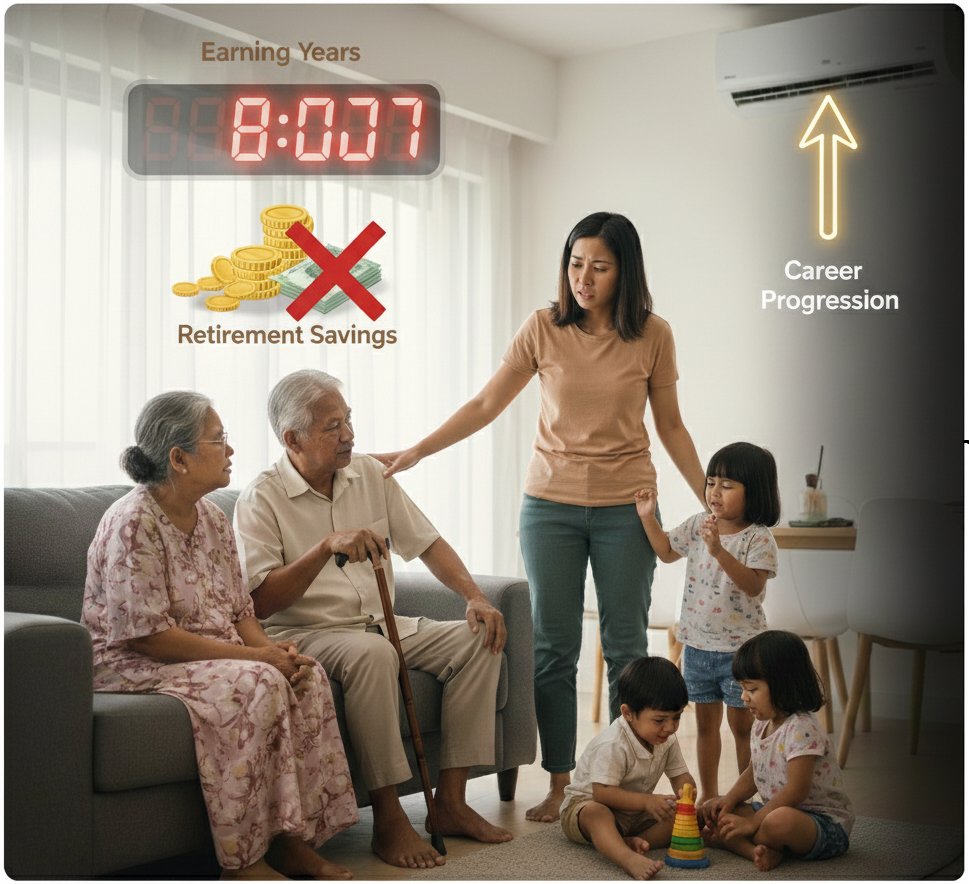

What we're avoiding: The brutal financial and emotional realities of caring for ageing parents whilst raising children and attempting to secure our own retirement.

Marlina Isa, 43, represents millions of millennials across Singapore who are discovering that the "sandwich generation" label isn't just a sociological term—it's a daily, exhausting financial calculus. As chronicled by Channel News Asia in September 2025, Marlina is on no-pay leave from her social service job, caring simultaneously for two ailing parents (her 83-year-old father with vascular dementia, her 82-year-old mother with irregular heart rhythm) and three sons, one of whom has dyslexia requiring intensive support through his Primary School Leaving Examination.

Her story isn't exceptional; it's increasingly typical. And here's what makes it financially precarious: whilst caring for her parents and children, Marlina is simultaneously depleting her own earning years, retirement savings, and career progression potential.

The Numbers Behind the Squeeze

Singapore became a super-aged society in 2026—meaning 21% or more of the population is aged 65 and older. By October 2025, we're already at 20.7% of citizens in this age group, up from 13.1% in 2015. More strikingly, the number of Singaporeans aged 80 and older surged 60% in the past decade, from 91,000 in June 2015 to 145,000 in June 2025—now comprising 4% of all citizens.

What does this mean for working professionals? You're statistically more likely than previous generations to have elderly parents requiring care, for longer periods, at higher costs, whilst your own working-age cohort shrinks.

The proportion of working-age Singaporeans (20-64) has fallen from 64.5% in 2015 to 59.8% in June 2025. Fewer workers. More elderly dependants. Higher care costs. The squeeze is mathematical before it becomes emotional.

The Financial Realities Nobody Mentions

CareShield Life payouts in 2025 are approximately S$662 per month. Meanwhile, Marlina and her husband tap into MediSave, MediShield, and personal savings to cover the gap—and they're "starting to feel the pinch." She's applied for the Home Caregiving Grant (up to S$400 per month per recipient, rising to S$600 from April 2026), the Pioneer Generation Disability Assistance Scheme (S$100 monthly), and Home Personal Care subsidies.

Even with these supports, the couple juggles:

- Her father's dementia day care costs

- Her mother's medication expenses

- Three sons approaching tertiary education

- Their own retirement savings (now being depleted)

- Lost income from Marlina's no-pay leave

According to research highlighted by Great Eastern Life in September 2025, three in five Singaporeans are worried about caregiving costs (60%), whilst four in five are worried about affording their own healthcare expenses (82%).

What We're Not Saying (But Should Be)

The conversation we're avoiding isn't "How do I afford eldercare?" It's deeper:

-

"Can I afford to be the primary caregiver?" For many women, especially, caregiving becomes the default expectation, derailing careers and retirement security. Marlina's decision to take no-pay leave is rooted in love and cultural obligation, but it has tangible financial consequences extending decades into her future.

-

"What do I owe my parents versus what do I owe my children and myself?" This isn't about shirking duty—it's about honest trade-offs. Every dollar and hour spent on eldercare is a dollar and hour not spent on children's enrichment or personal retirement savings.

-

"What are my siblings actually contributing?" Marlina's siblings help weekly, with brothers handling physical caregiving tasks and everyone chipping in financially. But in many families, caregiving responsibility falls disproportionately on one child—often the daughter, often the one who stayed closest to home—whilst others contribute minimally.

-

"How do I prevent becoming a burden to my own children?" If we're exhausted caring for our parents now, what makes us think our children won't face the same squeeze—except with even less government support and fewer siblings to share the load?

On 30 October at 27 Ann Siang Road, The Financial Coconut is hosting Care vs Cash: Millennials and the Realities of Caregiving in Singapore, featuring Bertha Henson (veteran journalist), Dr Chong Poh Heng (Medical Director, HCA Hospice), and Timothy Liew (Head of Investments, OCBC).

This isn't a panel about optimising eldercare subsidies. It's about the emotional and financial tightrope millennials walk daily, and what practical tools exist when love meets limited resources.

Conversation 2: Financial Trauma—When Past Money Wounds Control Present Decisions

What we're avoiding: How childhood poverty, past financial failures, or money-related shame silently dictate our adult financial behaviours in ways we don't recognise.

Imagine your heart pounding as you approach an ATM. Picture a stack of unopened bills radiating quiet menace from your kitchen counter. Think of sudden panic washing over you during retirement planning discussions.

For many high-earning professionals, these aren't signs of ordinary financial stress—they're symptoms of financial trauma, a term that describes the deeply distressing emotional, psychological, and even physiological response to disturbing financial events or chronic economic hardship.

What Financial Trauma Actually Looks Like

According to Dinok F. Wong, a Singapore-based financial social work specialist, financial trauma isn't defined by money lost—it's defined by the intensity of emotional response. It manifests in three forms:

Acute Financial Trauma: Sudden shocks like unexpected job loss, business failure, investment scams, stock market crashes wiping out retirement portfolios, or contentious divorces involving financial infidelity.

Chronic Financial Trauma: Prolonged exposure to scarcity—growing up in poverty, living with a parent who has gambling addiction, being trapped in long-term debt cycles, chronic underemployment, or enduring financial abuse in relationships.

Systemic Financial Trauma: Arising from historical or systematic disadvantage based on race, gender, disability, or other factors, creating persistent economic inequality.

In Singapore's high-pressure, success-oriented culture, financial trauma is particularly insidious because outward success often masks inward devastation. You can earn six figures whilst experiencing financial PTSD from a childhood of poverty. You can manage millions professionally whilst avoiding your own bank statements.

The Behavioural Symptoms We Mistake for Character Flaws

Financial trauma rewires our nervous system to perceive money as threat, manifesting in behaviours that look irrational but are actually trauma responses:

Financial Avoidance: Not opening bills, avoiding money conversations, not checking bank statements or CPF balances, procrastinating on important financial tasks. This is attempt to avoid triggering pain and anxiety.

Financial Hoarding: Extreme frugality to the point of self-deprivation, inability to enjoy resources, constant anxiety about running out regardless of actual wealth. Driven by intense fear of scarcity.

Compulsive Spending or Risk-Taking: Using spending as emotional balm or engaging in high-risk investing to "win back" losses, creating further devastation.

Workaholism: Tying entire self-worth to earning ability, leading to burnout, driven by deep-seated fear that stopping means collapse.

According to Psychology Today Singapore (October 2025), "Add layers of shame, past financial trauma, or differences in values, and it's no surprise that money talks can quickly become tense or avoidant."

What We're Not Saying (But Should Be)

The conversation we're avoiding isn't "How do I budget better?" It's:

-

"Where did I learn that money = danger?" Our earliest experiences shape unconscious "money scripts"—beliefs like "I will always be poor," "Money is evil," "I don't deserve wealth." These aren't conscious choices; they're trauma responses.

-

"Why do I self-sabotage when things are going well financially?" For those with chronic financial trauma, success can feel dangerous—triggering anxiety that "it will all be taken away," leading to self-destructive behaviours that confirm the original fear.

-

"How is my financial trauma affecting my children?" Forbes (August 2025) highlighted that "Generational financial trauma has a profound impact on your relationship with money and often starts before you are born." If you grew up with financial scarcity messaging, you may unconsciously transmit the same anxiety to your children—even when objectively secure.

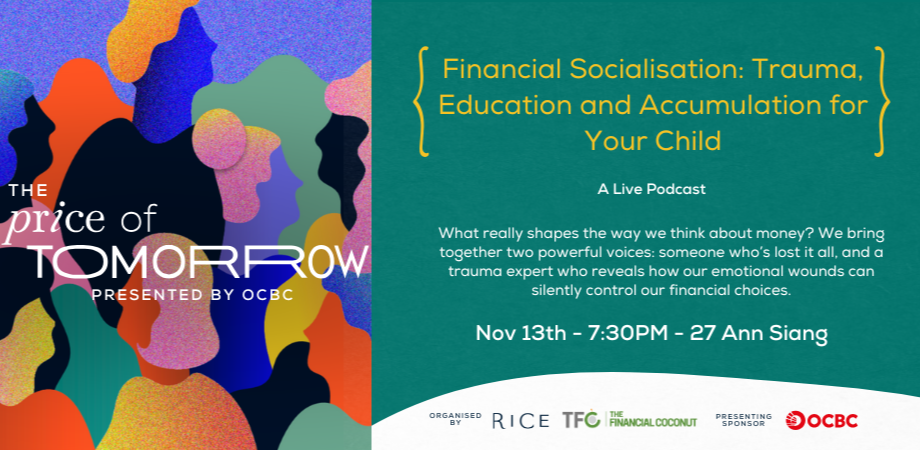

On 13 November at 27 Ann Siang Road, The Financial Coconut presents Financial Socialisation: Trauma, Education and Accumulation for Your Child, featuring Eddie Jui (TheLazyCabbie, who's rebuilt from financial ground zero), Dr Annabelle Chow (Principal Clinical Psychologist), and Elaine Teh (Head of Deposits, OCBC).

This conversation tackles how mental health shapes money relationships and why financial literacy must account for emotional wounds.

Conversation 3: Raising Money-Smart Children—Beyond Pocket Money and Savings Accounts

What we're avoiding: What we're actually teaching our children about money through our silences, anxieties, and unexamined behaviours—and how to do better.

Here's the paradox: high-earning professionals often obsess over their children's academic enrichment—tuition, music lessons, coding camps—but avoid substantive conversations about money. We give pocket money but don't explain household budgets. We model consumption but not conscious spending. We save for their university but don't teach them why.

The result? Children who are academically advanced but financially illiterate. Teenagers who understand calculus but not compound interest. Young adults who land high-paying jobs but immediately accumulate credit card debt because nobody taught them that income doesn't equal wealth.

What Financial Socialisation Actually Means

Financial socialisation is the process by which children acquire knowledge, attitudes, values, and behaviours related to money. It begins earlier than most parents realise—research shows children as young as three can grasp basic money concepts—and it happens whether we're intentional about it or not.

According to Eastspring Investments' Money Parenting resources, "Children as young as two to three-year-old are able to start learning" about earning, spending, saving, and donating. Yet many parents postpone money conversations until secondary school, by which point children have already formed subconscious money attitudes from observing parental behaviours.

What We're Actually Teaching (Without Realising It)

Your children are learning about money from:

What you don't say: Avoiding discussions about bills, job loss, financial stress teaches children that money is shameful or dangerous to discuss.

How you react to money stress: If you snap at family members when bills arrive, children learn that money causes conflict. If you stress-shop after bad days, they learn that spending soothes emotions.

What you model: If you constantly compare your lifestyle to neighbours, children learn that self-worth derives from material possessions. If you never discuss charitable giving, they learn that money is only for personal consumption.

The stories you tell: If your money narrative is "we can't afford that," children internalise scarcity even when objectively comfortable. If it's "money grows on trees," they develop unrealistic expectations.

The Singapore-Specific Complications

Singapore's hyper-competitive, materialistic culture adds unique pressures:

Academic arms race: When children see peers receiving lavish rewards for good grades, they conflate achievement with material consumption rather than intrinsic motivation or financial prudence.

Status anxiety: In a society where car ownership, property type, and brand names signal social standing, children absorb messages that worth equals wealth display.

Intergenerational wealth gaps: Some children grow up in households where money is never discussed because there's plenty; others in households where it's never discussed because there's shame. Both extremes produce financial illiteracy.

What We're Not Saying (But Should Be)

The conversation we're avoiding isn't "Should I give pocket money?" It's:

-

"What are my unconscious money beliefs, and am I transmitting them?" Before teaching children about money, examine your own money scripts. Are you teaching prudence or anxiety? Generosity or scarcity?

-

"How do I teach contentment in a consumerist culture?" Singapore's Cost of Living Index jumped 11% year-on-year to 85.3 in mid-2025, placing Singapore fifth globally. Children are bombarded with messages that happiness requires consumption. How do we counter this?

-

"What am I teaching through inheritance and financial support?" If you plan to leave substantial wealth, are you preparing children to manage it responsibly? Or will sudden wealth destroy their work ethic and purpose?

-

"How do I discuss our family's financial reality appropriately?" Age-appropriate financial transparency—explaining household budgets, why we save, why we can't afford certain luxuries—builds financial literacy. Secrecy breeds anxiety and unrealistic expectations.

Beyond the Piggy Bank: What Actually Works

Research-backed financial literacy approaches include:- Values-based conversations: Instead of "save 20% of pocket money," discuss "what matters most to you, and how does money help you achieve it?"

- Real-world involvement: Include age-appropriate children in family financial decisions—comparing grocery prices, planning holiday budgets, discussing utility consumption.

- Normalising money talk: Make money a regular, neutral conversation topic like homework or health, removing shame and mystery.

- Modelling financial resilience: When financial setbacks occur (job loss, unexpected expenses), demonstrate problem-solving rather than panic, teaching children that financial challenges are navigable.

At The Price of Tomorrow festival on 29-30 November at OCBC Wisma Atria, families can engage in hands-on activities and workshops designed to spark intergenerational money conversations. Featuring The Financial Coconut, Honeykids, Capital Gains Studio, and more, the festival creates safe space to "swap stories, challenge old habits, and reimagine what financial wellness could look like."

Why These Conversations Matter More Than Your Portfolio

High-earning professionals are exceptionally good at optimising financial instruments. We maximise CPF contributions, diversify investments, compare insurance policies, track expense ratios. These skills matter.

But they're insufficient if:

- You're financially secure yet emotionally trapped by childhood scarcity trauma

- Your portfolio compounds whilst your caregiving responsibilities compound faster

- You're building wealth for children you're inadvertently teaching to fear or worship money

The three conversations we're avoiding—caregiving trade-offs, financial trauma, and childhood money socialisation—aren't "soft" topics peripheral to "real" financial planning. They're the foundations upon which all technical financial decisions rest.

Your asset allocation is irrelevant if financial trauma causes you to panic-sell during volatility. Your retirement plan is compromised if you haven't discussed caregiving expectations with siblings. Your wealth accumulation is pyrrhic if your children develop unhealthy money relationships.

What "Financial Wellness" Actually Means

The Price of Tomorrow festival's core premise is that "financial wellness isn't one-size-fits-all." True financial wellness requires:

Technical competence: Understanding investments, insurance, taxation, estate planning.

Emotional resilience: Healing financial trauma, managing money anxiety, developing healthy money relationships.

Relational clarity: Having honest conversations with partners, parents, siblings, children about money expectations, obligations, and values.

Generational wisdom: Understanding how our money experiences shape us, and consciously choosing what to transmit to the next generation.

You can have perfect technical competence whilst failing spectacularly at the other three dimensions. And increasingly, as Singapore becomes super-aged, as costs of living surge, as children face different economic realities than we did, the conversations we're avoiding become more consequential than the ones we're having.

Breaking the Silence: How to Start

If you've recognised yourself in any of these three conversations—the sandwich generation squeeze, the financial trauma symptoms, the unexamined money messages you're transmitting—here's how to begin:

1. Create safe space. These conversations can't happen in crisis mode or during arguments. Schedule dedicated time, establish ground rules (no judgment, no interruptions), and acknowledge discomfort upfront.

2. Start with curiosity, not conclusions. Instead of "You need to contribute more to Mum's care," try "I'd like to understand how you're thinking about Mum's care needs and what feels manageable for you." Instead of "Why are you bad with money?" try "Help me understand your relationship with money and what makes financial decisions hard."

3. Seek professional guidance. Financial trauma recovery, family caregiving mediation, and childhood financial socialisation are specialised domains. Trauma-informed financial coaches, family therapists, and financial social workers exist for precisely these conversations.

4. Use communal spaces. Events like The Price of Tomorrow create permission structures for difficult conversations. When everyone's discussing caregiving trade-offs or financial trauma, it normalises topics that feel taboo in isolation.

5. Practice intergenerational dialogue. The festival's explicit goal is bringing families together across generations. Children learn by observing adults navigate uncomfortable money topics with respect and honesty.

The Price of Tomorrow Is What We Choose Today

The title The Price of Tomorrow is deliberately ambiguous. It asks: What will tomorrow cost us? But also: What are we willing to pay today to secure a better tomorrow?

For the sandwich generation, the price might be difficult conversations with siblings about equitable caregiving distribution, or honest discussions with parents about their care preferences and financial reality.

For those carrying financial trauma, the price might be the vulnerability of admitting that despite outward success, you're still controlled by childhood scarcity messages—and seeking professional help to heal.

For parents, the price might be examining your own unconscious money beliefs before transmitting them to children, and creating age-appropriate financial transparency even when it's uncomfortable.

These conversations are hard. They surface shame, obligation, guilt, fear, resentment. They challenge cultural norms about filial piety, success, and financial privacy. They require emotional labour on top of already exhausting lives.

But the alternative—continued silence—has its own price. Caregiver burnout. Financial trauma cycling through generations. Children who are materially provided for but financially illiterate. Families fractured by unspoken resentments about money.

As Singapore hurtles toward super-aged status, as costs of living surge, as economic volatility becomes baseline rather than exception, the conversations we're avoiding become more expensive with each passing year.

The Price of Tomorrow festival isn't offering easy answers. It's offering what we actually need: space to ask hard questions, permission to be vulnerable, and community to navigate complexity together.

Because financial wellness—real financial wellness—isn't built in isolation. It's not found in portfolio optimisation alone. It emerges from honest conversations about care, trauma, values, and what we owe each other across generations.

The three conversations you aren't having? It's time to start.

Join The Conversation

Care vs Cash: Millennials and the Realities of Caregiving in Singapore

📅 Thursday, 30 October 2025, 7:30 PM

📍 27 Ann Siang Road, Singapore

🎙️ Featuring: Bertha Henson, Dr Chong Poh Heng, Timothy Liew

🎫 Free admission

Financial Socialisation: Trauma, Education and Accumulation for Your Child

📅 Thursday, 13 November 2025, 7:30 PM

📍 27 Ann Siang Road, Singapore

🎙️ Featuring: Eddie Jui (TheLazyCabbie), Dr Annabelle Chow, Elaine Teh

🎫 Free admission

The Price of Tomorrow: A Financial Wellness Festival

📅 Saturday-Sunday, 29-30 November 2025, 11:00 AM - 4:00 PM

📍 OCBC Bank | Wisma Atria, 435 Orchard Rd, #04-01

🎉 Two days of panel discussions, interactive workshops, and hands-on activities

🎫 Free admission

Presented by OCBC, in partnership with The Financial Coconut and RICE Media.

Register at www.thefinancialcoconut.com/events

Let us know what you think about this topic, and events and what would you want to see next.

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

References

- Channel News Asia, "The realities of life for this sandwich carer, and the support she can tap"

- The Straits Times, "Number of Singaporeans aged 80 and older jumped 60 per cent in the past decade"

- Dinok F. Wong, "Healing the Hidden Wounds: A Guide to Financial Trauma Recovery"

- National Population and Talent Division, "Population In Brief 2025"

- Great Eastern Life, "Sandwich Gen: Caring for Singapore's super aged"

- Psychology Today Singapore, "Why Talking About Money Is the Last Great Taboo"

- Psychology Today Singapore, "Money Boundaries and Mental Health"

- Forbes, "The Truth About Generational Financial Trauma"

- Eastspring Investments, "20 Things to Teach Your Child About Finances"

- CNBC, "More Singaporeans are living paycheck to paycheck"

-4.png?width=50&name=Square%20(2)-4.png)

-2.png?height=200&name=2024%20website%20assets%20(1)-2.png)

Let us know what you think of this post