Top 10 FX Cards for Singapore's Business Elite

As Singapore continues to cement its position as Asia's financial hub, the demand for sophisticated foreign exchange solutions amongst high-earning professionals has never been more pronounced. With business travel rebounding to pre-pandemic levels and cross-border transactions becoming increasingly complex, the choice of FX card can significantly impact both your bottom line and operational efficiency.

Our research reveals that Singapore's affluent professionals—from investment bankers shuttling between Hong Kong and London to tech entrepreneurs managing global teams—are collectively losing thousands of dollars annually through suboptimal FX card selection. This comprehensive guide examines the ten most compelling FX card options available to Singapore's business elite, with particular attention to cost optimisation and feature sophistication.

The High-Stakes World of Corporate FX

Recent data suggests that Singapore-based high-net-worth individuals and business owners conduct an average of S$50,000-S$200,000 in foreign currency transactions annually. At traditional bank FX margins of 2-3%, this translates to S$1,000-S$6,000 in unnecessary costs—funds that could otherwise contribute to investment portfolios or business expansion.

The landscape has evolved considerably since 2023, with new players entering the market and established providers enhancing their offerings. "The differentiation between FX providers is becoming increasingly nuanced," observes a senior executive at a leading Singapore-based fintech firm. "High-earning professionals are no longer satisfied with basic currency conversion—they demand comprehensive financial ecosystems."

Here's our summary but read more for the full details below

Our Top 10 FX Cards for Singapore's Business Elite

1. WorldFirst World Card

Best for: Cross-border e-commerce and China-focused businesses

WorldFirst's World Card emerges as a compelling option for Singapore's business owners engaged in international trade, particularly those with significant exposure to Chinese markets. The card offers zero FX fees across 15 major currencies when you maintain balances in corresponding currency accounts within your WorldFirst multi-currency account.

Key Features:

- Zero FX fees on 15 supported currencies from account balances

- Spending capability across 150+ currencies in 210+ countries

- Integration with major marketplaces including Amazon and 1688.com

- No annual card fees

- Real-time spending notifications and controls

Cost Analysis: Exchange rates include margins up to 0.6% for major currencies, whilst transfers to Chinese suppliers via 1688.com incur a 0.8% fee. Local transfers start from S$1.30, with SWIFT transfers beginning at S$6.70.

WorldFirst's particular strength lies in its China-centric infrastructure, making it invaluable for Singapore businesses with significant mainland operations. However, the requirement to pre-fund currency accounts may not suit all cash flow patterns.

2. Wise Multi-Currency Card

Best for: Frequent international travellers and transparent pricing advocates

Wise continues to set the benchmark for transparency in FX services, offering the genuine mid-market exchange rate with conversion fees starting from 0.43%. For Singapore's high-earning professionals who value straightforward pricing, Wise represents an compelling proposition.

Key Features:

- True mid-market exchange rates

- Hold and exchange 40+ currencies

- Conversion fees from 0.43%

- Two free ATM withdrawals up to S$350 monthly

- Apple Pay and Google Pay compatibility

Cost Analysis: The S$8.50 card delivery fee represents negligible cost for most professionals, whilst the 1.75% + S$1.50 fee for ATM withdrawals beyond the monthly allowance remains competitive. Most importantly, Wise's commitment to mid-market rates eliminates the hidden margins found in traditional banking products.

For Singapore's investment professionals managing portfolios across multiple currencies, Wise's transparency allows for precise cost accounting—a critical factor in performance attribution analysis.

3. Revolut Premium/Metal Cards

Best for: Technology-forward professionals requiring comprehensive financial services

Revolut's premium tiers offer sophisticated features that appeal to Singapore's tech-savvy high earners. The Metal plan (S$19.99 monthly) provides unlimited currency exchange without fair usage fees—a significant advantage for frequent traders or business owners with substantial FX requirements.

Key Features:

- Premium: S$15,000 monthly exchange limit (0.5% fee thereafter)

- Metal: Unlimited exchanges with no fair usage fees

- Competitive exchange rates during market hours

- Five free international ATM withdrawals up to S$350 monthly

- Integrated cryptocurrency trading

Cost Analysis: The Metal subscription cost of S$240 annually becomes negligible for professionals conducting substantial FX transactions. However, the 1% out-of-hours exchange fee can impact those requiring immediate currency conversion outside standard market hours.

4. YouTrip Multi-Currency Card

Best for: Asian business travellers and straightforward multi-currency needs

YouTrip's strength lies in its simplicity and focus on the ten most commonly traded currencies by Singapore businesses. The card provides wholesale Mastercard exchange rates with zero foreign transaction fees—a compelling proposition for professionals with predictable travel patterns.

Key Features:

- Support for 10 major currencies for holding and conversion

- Wholesale Mastercard exchange rates

- Zero foreign transaction fees

- Free ATM withdrawals up to S$400 monthly

- No annual fees

Cost Analysis: The 2% ATM withdrawal fee beyond the monthly allowance represents the primary cost consideration. For business travellers who primarily use cards for purchases rather than cash withdrawals, YouTrip offers excellent value.

5. HSBC Everyday Global Card

Best for: Established professionals seeking traditional banking relationships

HSBC's Everyday Global solution appeals to Singapore's established business community, offering the security and service levels associated with premier banking relationships. The card supports ten currencies with zero fees when sufficient foreign currency balances are maintained.

Key Features:

- Zero fees for transactions in ten supported currencies

- Competitive interest rates up to 3.70% p.a. on SGD balances

- Global ATM access through HSBC network

- Premier customers enjoy enhanced benefits

- Integration with HSBC's broader private banking services

Cost Analysis: The 1.5% foreign currency transaction fee (plus up to 1% Visa charges) applies when spending currencies not held in your account. However, for HSBC Premier customers, the value proposition improves significantly through waived fees and enhanced exchange rates.

6. DBS Multi-Currency Account and Card

Best for: Singapore-centric businesses with moderate international exposure

As Singapore's largest bank, DBS offers a comprehensive multi-currency solution supporting 13 currencies. The integration with DBS's broader business banking suite makes it attractive for established Singapore companies.

Key Features:

- Support for 13 major currencies

- Integration with DBS business banking platform

- Established local presence and support

- ATM access through extensive Asia-Pacific network

Cost Analysis: The foreign transaction fee of up to 3.25% when spending unsupported currencies represents a significant cost for businesses with diverse geographic exposure. International ATM fees up to S$7 also diminish the value proposition for frequent travellers.

7. UOB Mighty FX Card

Best for: Cost-conscious professionals with established UOB relationships

UOB's solution offers reasonable functionality at competitive pricing, particularly for existing UOB customers who can leverage relationship benefits.

Key Features:

- Support for ten foreign currencies

- S$18 annual fee (waived for first three years)

- Integration with UOB's digital banking platform

- Established Singapore presence

Cost Analysis: The 2.25% foreign transaction fee for unsupported currencies and S$5 ATM withdrawal charges limit its appeal for intensive international users, but the three-year fee waiver provides initial value.

8. OCBC Multi-Currency Business Account

Best for: SMEs requiring integrated business banking solutions

OCBC's business-focused multi-currency solution supports 13 currencies with particular strength in regional Asian markets.

Key Features:

- 13 supported currencies including regional Asian options

- Business-focused features and reporting

- Integration with OCBC's commercial banking platform

- Established corporate relationships

OCBC's offering includes preferential FX rates through June 2025 for major currencies, providing temporary cost advantages for businesses planning significant transactions.

9. Changi Pay

Best for: Frequent Asian travellers and China market participants

Changi Pay leverages the Alipay+ network to provide seamless payments across 40+ countries, with particular strength in the Asia-Pacific region.

Key Features:

- QR code payments via Alipay+ network in 40+ countries

- Competitive exchange rates with no transaction fees

- Rewards programme with e-vouchers

- Integration with Changi Airport ecosystem

Cost Analysis: The absence of transaction and service fees for overseas payments via the Alipay+ network provides significant cost advantages for Asian business travel. Current promotions offer S$25 e-vouchers for every S$500 in overseas spending through September 2025.

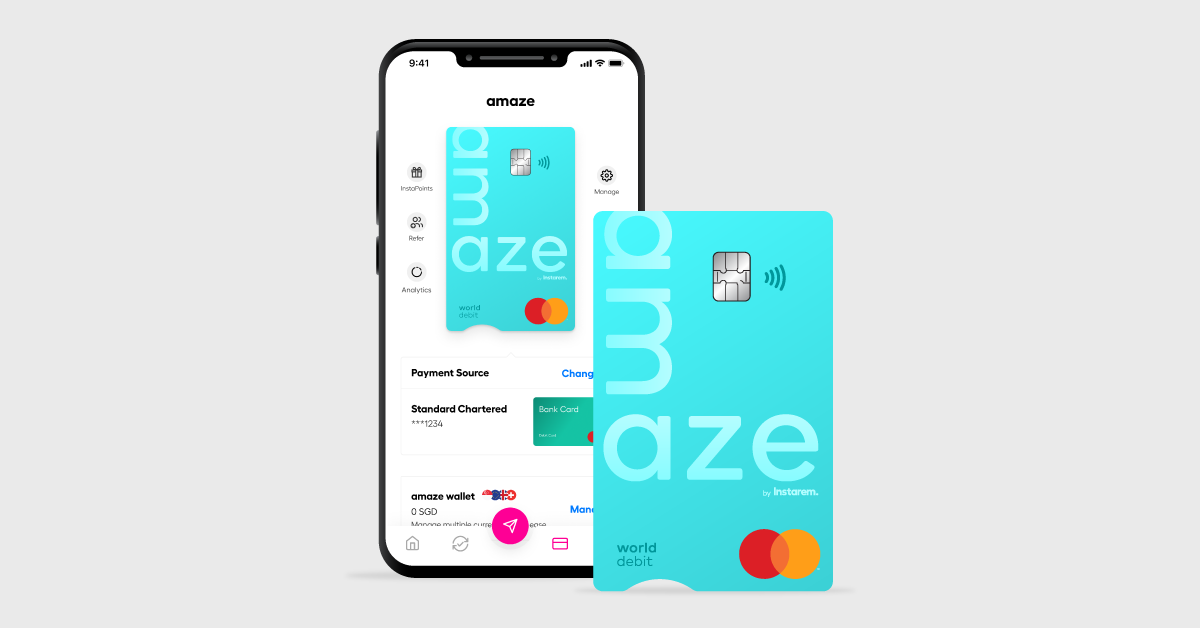

10. Instarem Amaze Card

Best for: Multi-card managers seeking consolidated expense tracking

Instarem's Amaze Card provides unique functionality by allowing users to link up to five existing credit or debit cards, offering consolidated expense management for professionals juggling multiple payment methods.

Key Features:

- Link up to five existing cards for unified management

- Support for nine currencies (beyond SGD top-ups)

- Mastercard World benefits

- Cashback rewards on international spending

- Google Pay compatibility

Cost Analysis: The 2% ATM withdrawal fee and 1% funding fee (minimum S$0.50) when using linked bank cards represent moderate costs, but the consolidated expense tracking may provide valuable operational efficiency for busy professionals.

:max_bytes(150000):strip_icc()/5FactorsThatInfluenceExchangeRates-f305d6b13db54aa291ca07f1602d141a.jpg)

Strategic Considerations for High-Earning Professionals

The True Cost of Foreign Exchange

Our analysis reveals that exchange rate margins often represent the largest cost component for high-volume FX card users. A seemingly attractive "zero fee" card offering exchange rates 1.5% above the mid-market rate will ultimately cost more than a transparent provider charging 0.5% on true interbank rates.

Consider a Singapore-based investment professional conducting S$100,000 in annual foreign currency transactions. Using a traditional bank card with 2.5% total costs results in S$2,500 in annual fees. Switching to Wise's mid-market rate structure with 0.5% average costs reduces this to S$500—a saving of S$2,000 annually.

Integration with Wealth Management

For Singapore's high-net-worth individuals, FX card selection should align with broader wealth management strategies. Cards offering multi-currency holding capabilities can serve as tactical currency exposure tools, allowing professionals to maintain strategic foreign currency positions whilst meeting operational payment needs.

Operational Efficiency Considerations

Time represents the ultimate luxury for high-earning professionals. Cards offering comprehensive mobile applications, real-time notifications, and automated expense categorisation can significantly reduce administrative burden. The operational efficiency gains from premium card features often justify higher annual fees for professionals whose time carries substantial opportunity costs.

Regulatory and Compliance Landscape

Singapore's Monetary Authority continues to strengthen oversight of electronic payment services, with recent guidelines emphasising consumer protection and operational resilience. All featured providers maintain appropriate licensing under Singapore's Payment Services Act, ensuring regulatory compliance and deposit protection where applicable.

For professionals managing substantial foreign currency exposure, understanding each provider's regulatory status and deposit insurance coverage becomes crucial for risk management purposes.

Looking Ahead: The Future of FX Cards in Singapore

The competitive landscape continues evolving rapidly, with artificial intelligence enabling more sophisticated risk management and pricing algorithms. We anticipate increased personalisation in FX offerings, with providers tailoring rates and features based on individual transaction patterns and relationship depth.

Cryptocurrency integration represents an emerging frontier, with several providers exploring digital asset functionality for tech-forward professionals comfortable with alternative payment rails.

Conclusion: Optimising Your FX Strategy

For Singapore's high-earning professionals, the choice of FX card transcends simple cost comparison. The optimal solution balances exchange rate competitiveness, operational efficiency, integration with existing financial relationships, and alignment with broader wealth management objectives.

Professionals conducting substantial international business should maintain relationships with multiple providers, leveraging each for their particular strengths. A primary relationship with Wise or WorldFirst for cost-effective major currency transactions, complemented by a premium traditional bank card for relationship management and emergency access, often provides optimal flexibility.

The key lies in understanding your specific transaction patterns, geographic exposure, and operational requirements. In an era where marginal gains compound into substantial advantages, the sophistication of your FX strategy may well determine your competitive edge in the global marketplace.

Sources:

- Wise Multi-Currency Cards Singapore 2025

- SingSaver Best Multi-Currency Cards 2025

- WorldFirst Singapore Business Solutions

- Airwallex WorldFirst Singapore Review

- HSBC Everyday Global Account

- Revolut Singapore Pricing

This article is based on publicly available information as of June 2025. Fees and features may vary based on individual circumstances and should be verified directly with providers before making financial decisions.

Let us know what you think about this topic, and what do you want to hear next.

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

-3.png?width=50&name=Square%20(2)-3.png)

Let us know what you think of this post