Financial Phishing Scams: Singapore, Indonesia & India Top Global Worry List

As financial phishing scams grow increasingly sophisticated (often powered by AI), countries like Singapore, Indonesia, and India are at the forefront of global high alert.

These nations not only report high levels of worry about falling victim to phishing but also face significant challenges in combating these threats.

With 71% of global respondents in a (YouGov) survey dated January 2025, they have expressed concern about AI-enhanced scams,

It’s clear that phishing is a growing menace demanding urgent action from both banks and individuals. Here’s a closer look at the trends, concerns, and responsibilities shaping this global issue.

Global Concern About Financial Phishing Scams

- Widespread Awareness:

- 71% of respondents across 17 international markets are worried about AI-enhanced phishing threats.

- Despite this, 59% globally feel confident in identifying phishing attempts.

- Top Concerned Countries:

- Singapore: Leads with 72% concerned about falling victim to phishing scams.

- Indonesia: Follows closely at 70%, alongside India at 69%.

- AI-Enhanced Scams Add Complexity:

- Countries like Singapore (80%) and Australia (80%) express the highest concern about AI-driven phishing threats.

- UK (79%), USA and Canada (76%), and India and Indonesia (75%) also rank among the most worried.

Confidence in Spotting Phishing Scams

| Confidence Level | Details |

|---|---|

| 1. High Confidence Countries |

|

| 2. Low Confidence Countries |

|

Who Should Take Responsibility?

- Banks:

- 74% believe banks should do more to educate customers about phishing risks.

- Only 53% say their bank provides adequate protection against phishing.

Source: OCBC

- Individuals:

- 74% agree that individuals must take greater responsibility for protecting themselves.

Current Bank Support and Effectiveness

- Protection Levels:

- 53% of respondents feel their bank offers good protection against phishing.

- Awareness Training:

- 37% have received phishing awareness training from their bank.

- The majority found such training very or somewhat helpful.

Preferred Frequency for Phishing Awareness Updates

- Regular Updates:

- Monthly updates are preferred by 30% of respondents.

- Quarterly updates are favoured by 19%, while weekly updates appeal to 13%.

- Event-Based Alerts:

- 17% prefer updates only during major scam incidents.

Key Insights for Singapore, Indonesia & India

| Key Insight | Details |

|---|---|

| 1. Why These Countries Are Most Worried |

|

| 2. AI-Driven Threats Amplify Risk |

|

| 3. Moderate Confidence Levels |

|

To-Dos for Banks and Individuals

For Banks:

- Increase Awareness Training: Provide regular phishing awareness updates to customers, tailored to their preferences (e.g., monthly or quarterly).

- Enhance Protections: Strengthen fraud detection systems and offer real-time alerts for suspicious activities.

- Simplify Reporting: Make it easier for customers to report phishing attempts and resolve issues quickly.

For Individuals:

- Stay Informed: Regularly update knowledge about phishing tactics, especially AI-driven threats.

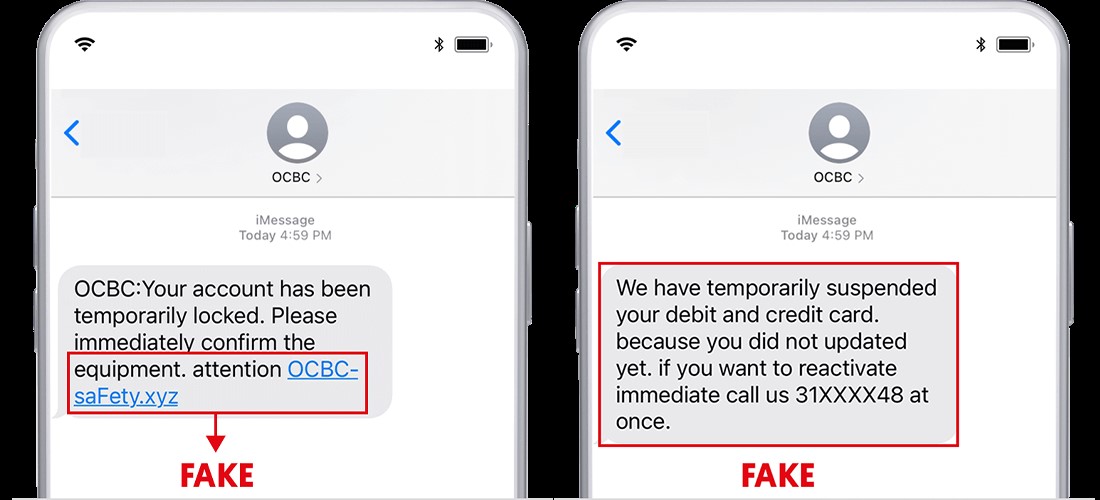

- Adopt Best Practices: Use strong passwords, enable two-factor authentication, and avoid clicking on suspicious links.

- Report Scams: Notify banks and authorities immediately if targeted by phishing attempts.

Don’ts for Banks and Individuals

For Banks:

- Don’t Overlook Vulnerable Customers: Tailor education efforts to include less tech-savvy demographics.

- Don’t Delay Response: Ensure timely resolution of reported phishing incidents to maintain trust.

For Individuals:

- Don’t Share Personal Information: Avoid disclosing sensitive data like passwords or OTPs, even if the request appears legitimate.

- Don’t Ignore Updates: Stay engaged with phishing awareness materials provided by banks.

Bottom Line

The rise of AI-enhanced phishing scams has placed Singapore, Indonesia, and India at the epicenter of global concern.

While banks and individuals share responsibility for combating these threats, proactive measures are essential to close the gap between awareness and preparedness.

By staying vigilant, adopting best practices, and fostering collaboration, these countries can better protect their citizens from the growing menace of financial phishing scams.

Let us know what you think about this topic, and what do you want to hear next.

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

-Jun-01-2025-06-24-42-9139-PM.png?width=50&name=Square%20(2)-Jun-01-2025-06-24-42-9139-PM.png)

Let us know what you think of this post