BNPL Growth in Singapore: How It’s Evolving to S$1.94 Billion by 2030

Singapore’s Buy Now, Pay Later (BNPL) market is rapidly transforming the way consumers manage payments. With a projected market size of S$1.94 billion by 2030, BNPL is becoming a cornerstone of the country’s digital payment ecosystem.

Here’s a detailed look at the factors driving this growth, key players shaping the industry, and the regulatory landscape guiding its evolution.

Market Size & Growth

- 2025 Market Size: Singapore’s BNPL market is expected to grow by 11.1% annually, reaching S$1.32 billion in 2025.

- CAGR 2021-2024: The market grew at a compound annual growth rate (CAGR) of 19.3% during this period.

- CAGR 2025-2030: A forecasted annual growth rate of 7.9% will drive the market forward.

- 2030 Market Projection: The market is expected to expand from S$1.19 billion in 2024 to S$1.94 billion by 2030.

This steady growth underscores the increasing adoption of BNPL as a preferred payment method among Singaporeans.

Key Drivers

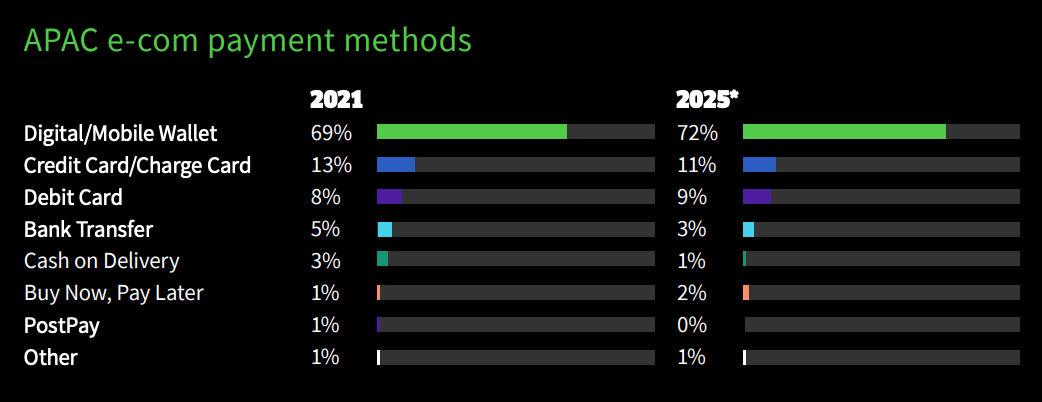

E-commerce Growth

- The rise of online retail has fueled BNPL adoption.

- Consumers increasingly prefer flexible, installment-based payment options for e-commerce purchases.

Consumer Demand

- There is growing demand for alternative credit solutions, particularly interest-free installment plans.

- BNPL integration into daily transactions has made it more accessible and appealing to a wider audience.

These drivers highlight the alignment of BNPL with modern consumer preferences and shopping habits.

Key Players & Mergers

Established Players

- Leading companies like Atome, GrabPay, and Rely dominate the market.

Acquisitions

- Pace Enterprise acquired Rely, consolidating market share.

- ShopBack acquired Hoolah, signaling a trend toward mergers and acquisitions.

These strategic moves reflect efforts to strengthen market presence and streamline operations.

Integration of BNPL

New Sectors

- BNPL services are expanding beyond retail into sectors like:

- Transportation: Grab’s PayLater service allows users to pay for rides and deliveries in installments.

- Utilities: BNPL is being integrated into utility bill payments.

Consumer Reach

- BNPL is now a key component of Singapore’s digital payment ecosystem, making it a mainstream payment option.

This diversification demonstrates the versatility and adaptability of BNPL services.

Strategic Partnerships

- Collaborations such as ShopBack acquiring Hoolah have increased market engagement.

- Integrating BNPL with cashback programs enhances consumer appeal and loyalty.

These partnerships highlight the importance of innovation and synergy in capturing market share.

Regulatory Oversight

Regulation by MAS

- The Monetary Authority of Singapore (MAS) supports industry self-regulation through a BNPL Code of Conduct.

- Key measures include:

- Age restrictions: Ensuring BNPL services are accessible only to eligible consumers.

- Credit limits: Preventing over-indebtedness among users.

Future Regulations

- Stricter compliance requirements may emerge to ensure responsible lending and consumer protection.

Regulatory oversight aims to balance growth with sustainability, protecting both consumers and the financial system.

Market Outlook

Competition

- The BNPL market will continue to expand, with new providers entering the space.

- Established players will face increasing competition as the market matures.

Challenges

- Regulatory scrutiny is expected to intensify, focusing on:

- Consumer protection.

- Sustainable business practices.

These challenges will shape the future trajectory of the BNPL industry.

Summary of Key Trends

- Rapid Growth: Driven by digital commerce and consumer preference for flexible payment options.

- Market Expansion: BNPL services are moving beyond retail into daily services like transportation and utilities.

- Consolidation: Strategic mergers and acquisitions (e.g., Pace acquiring Rely, ShopBack acquiring Hoolah).

- Regulatory Focus: MAS may introduce stricter regulations to ensure sustainable growth and consumer protection.

APAC e-commerce payment methods, Source: 2022 Global Payments Report by Worldpay from FIS

APAC e-commerce payment methods, Source: 2022 Global Payments Report by Worldpay from FIS

What Does This Mean for Singapore?

The rapid growth of BNPL in Singapore reflects its potential to reshape consumer finance.

For businesses, BNPL offers opportunities to tap into new customer segments and increase sales.

For consumers, it provides greater flexibility in managing expenses. However, regulatory oversight will play a critical role in ensuring responsible usage and preventing financial risks.

As the market evolves, stakeholders must stay informed about emerging trends and regulatory changes.

By doing so, they can navigate the BNPL landscape effectively and capitalise on its benefits while mitigating potential downsides.

Singapore’s BNPL market is poised to reach S$1.94 billion by 2030, driven by e-commerce growth, consumer demand, and strategic expansions into new sectors.

While mergers and partnerships consolidate market power, regulatory oversight ensures sustainable practices.

As BNPL becomes an integral part of the digital payment ecosystem, its continued evolution will redefine how Singaporeans shop and manage finances.

Let us know what you think about this topic, and what do you want to hear next.

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

-3.png?width=50&name=Square%20(2)-3.png)

Let us know what you think of this post