Over S$4,000 in Perks: Why SMEs Are Choosing the UOB Business Kit

TL;DR

The UOB Business Kit offers SMEs in Singapore over S$4,000 in value with cash rebates, digital tools, insurance coverage, and a hassle-free Banker’s Guarantee—all tailored to support business growth and reduce operational costs. With low fees, free subscriptions to business software, and a strong SME support community, UOB continues to solidify its role as the world’s best SME bank.

Key Takeaway:

-

Over S$4,000* in value via savings, insurance, and digital tools

-

Cashback rewards of over S$600/month on selected transactions

-

Free and discounted subscriptions to major business solutions

-

Hassle-free guarantees with zero collateral requirements

-

All backed by Singapore’s most SME-focused bank

Unlocking SME Growth: UOB’s Business Kit Offers a Smarter Way to Bank and Scale

Singapore’s small and medium enterprises (SMEs) are the backbone of the economy, contributing more than 40% to GDP and employing over two-thirds of the local workforce, according to Enterprise Singapore. Yet, SMEs often face one persistent challenge—how to grow efficiently without burning capital.

United Overseas Bank (UOB), recently crowned the World’s Best SME Bank by Global Finance, has designed a powerful, all-in-one solution to help: the UOB Business Kit. It’s a well-rounded package that combines banking, digital tools, and insurance in one cost-efficient offering—specifically tailored for local SMEs.

What’s Inside the UOB Business Kit?

Here’s a breakdown of what SMEs can get from the package—and how it delivers real value.

1. Cashback That Adds Up

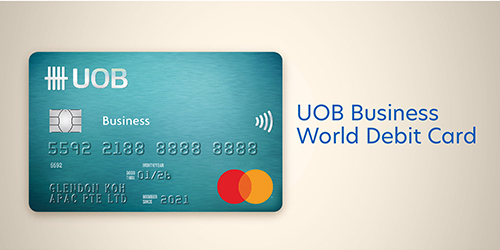

With the UOB Business World Debit Card, SMEs can earn:

-

Up to 1.5% cash rebate on overseas and local spend.

-

Over S$600 monthly cashback when using GIRO, FAST or telegraphic transfers

On top of that, UOB’s Transaction Cashback Promotion allows businesses to claim further rebates on eligible payments, subject to terms.

2. Low Banking Costs

-

Maintain your business account for just S$3/month, one of the most competitive in Singapore.

-

Enjoy free local payments, easing your transactional burden.

3. Zero-Collateral Banker’s Guarantee

Need a Banker’s Guarantee to secure tenders, rental agreements or contracts?

UOB offers a collateral-free solution—

“No facility fee, no annual fee, and no collateral or financial documents required,”

—making it a game-changer for small businesses looking to grow without tying up capital.

4. Free Business Insurance

Through UOB BizCare, SMEs enjoy 3 months of complimentary insurance, covering nine essential risks. For businesses navigating economic uncertainty, this offers valuable peace of mind.

5. Free Digital Solutions via UOB BizSmart

A major pain point for SMEs is the lack of digital infrastructure. UOB addresses this with:

-

Exabytes: Free AI-powered hosting and domain for 1 year (worth up to S$899)

-

Xero Cloud Accounting: 1-month free trial + 6 months free (worth up to S$390)

-

NETS Services: 6-month free POS & SGQR label (worth S$300)

-jfif.jpeg?width=1080&height=760&name=Image%20(12)-jfif.jpeg)

Combined, these software integrations could save SMEs hundreds—if not thousands—while streamlining operations.

6. Preferential Mobile and Broadband Rates

SMEs also gain access to preferential rates for Singtel business mobile and broadband, ensuring seamless connectivity for remote work or e-commerce ventures.

Building a Community Around SMEs

Banking with UOB isn’t just transactional—it’s also relational. Businesses that sign up are invited to join the UOB SME Community, where they can access expert advice, insights, and networking opportunities through go.uob.com/community.

Plus, with the UOB SME app, users can:

-

View cashflow trends

-

Access personalised insights

-

Get preferred FX rates

Why It Matters for Singaporean Businesses

In a rising interest rate and inflationary environment, any opportunity to reduce costs while improving operational efficiency is a competitive advantage. SMEs often struggle with time, talent, and tools. The UOB Business Kit solves for all three.

A 2024 survey by UOB noted that over 60% of SMEs cited cashflow and rising costs as their top business challenges. In response, tailored offerings like this business kit help entrepreneurs maintain agility while staying resilient.

| Top Business Challenges | 2025 | 2024 |

|---|---|---|

| Increasing costs / reduced profitability | 66% | 50% |

| Sales growth / reduced customer spending | 56% | 40% |

| Finances (cash flow, funding, etc.) | 51% | 36% |

| Growing the business | 50% | 36% |

| Increasing competition | 50% | 39% |

| Top Business Concerns | 2025 | 2024 |

|---|---|---|

| Cost of running the business | 62% | 39% |

| Getting / keeping customers | 55% | 37% |

| Long-term profitability | 53% | 34% |

| Cost of staff | 48% | 33% |

| Economic downturns (SG/other countries) | 48% | 29% |

Whether you're a sole proprietor, scaling start-up or established SME, the UOB Business Kit positions itself as more than a bank account—it's a full ecosystem. By bundling essential services under one roof and reducing entry barriers like fees and collateral, it empowers businesses to grow smarter, not harder.

For commercial Singaporean readers navigating tighter margins and tougher competition, this is one kit worth unpacking.

Ready to Level Up?

👉 Start now: go.uob.com.sg

👉 Join the SME community: go.uob.com/community

Terms and conditions apply. Visit UOB’s website for full promotion details.

Let us know what you think about this topic, and what do you want to hear next.

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

-3.png?width=50&name=Square%20(2)-3.png)

Let us know what you think of this post