The Rise of Thematic Investing in Singapore

Singapore's investment landscape is experiencing a seismic shift. As the nation's assets under management (AUM) reached a record S$6.07 trillion in 2024—a robust 12% increase from the previous year—a growing cohort of high-earning professionals, business owners, and sophisticated investors are abandoning traditional broad-market strategies in favour of thematic investing approaches that target specific long-term structural trends.

This pivot represents more than mere portfolio diversification; it reflects a fundamental reimagining of how Singapore's affluent investors view risk, opportunity, and the future itself. In an era where technological disruption, demographic shifts, and environmental pressures are reshaping entire industries, thematic investing offers a compelling proposition: the ability to position capital ahead of transformative waves rather than merely riding market beta.

The Numbers Tell the Story

The data emerging from Singapore's financial sector paints a picture of remarkable momentum. According to the Monetary Authority of Singapore's (MAS) 2024 Asset Management Survey, 48% of total AUM managed by Singapore-based asset managers now incorporates environmental, social, and governance (ESG) overlays—a clear indicator that thematic considerations have moved from niche to mainstream.

Perhaps more telling is the demographic breakdown of this trend. Research by the United Nations Development Programme revealed that two-thirds of Singapore's young millennials (ages 25-34) have invested in ESG products, with this figure rising to 82% among Generation Z investors (ages 21-24). These ESG investments account for 31% of their portfolios on average.

"The strength of technology-heavy, fossil-fuel-light ESG portfolios in 2020 and 2021 helped sustainable funds outperform broader markets and attract Asian retail investors, who had been reticent due to concerns about sacrificing returns," notes Leena Dagade, lead analyst for Asia ESG at Cerulli Associates.

The Thematic Revolution: Beyond Traditional Boundaries

Unlike conventional sector-based investing, thematic strategies cut across traditional industry classifications to capture multi-decade structural changes. Singapore-based robo-adviser StashAway, which launched its Thematic Portfolios in late 2021, defines the approach as "capitalising on longer-term trends and emerging sectors that have the potential to reshape industries and drive future growth."

The platform's recent portfolio refresh in December 2024 illustrates the dynamic nature of thematic investing. Their Technology Enablers portfolio now includes dedicated allocations to artificial intelligence through Xtrackers's Artificial Intelligence & Big Data UCITS ETF and cybersecurity via First Trust's Nasdaq Cybersecurity ETF, reflecting the rapid evolution of these sub-themes.

This evolution reflects broader market dynamics. Global semiconductor sales are projected to grow by 11.2% in 2025, positioning Singapore—with its strategic role in the global semiconductor supply chain—to benefit from rising demand for AI technologies and consumer electronics.

The Singapore Advantage: Gateway to Global Themes

Singapore's unique position as a financial hub amplifies the appeal of thematic investing for local investors. With 77% of Singapore's AUM sourced from outside the country and 88% invested globally, the city-state serves as a natural conduit for capturing global thematic trends whilst maintaining geographical diversification.

This global orientation is particularly relevant as thematic trends transcend borders. Robeco's fintech strategy, for instance, maintains significant exposure to emerging markets "where fintech challengers often face little resistance from incumbents and consumer adoption of online services is faster," according to Portfolio Manager Patrick Lemmens.

Image source: Robeco, Patrick Lemmens, Executive Director and Lead Portfolio Manager for Global Financials and Fintech at the Dutch asset management firm Robeco

The firm's thematic approach has identified three key sub-trends for 2025: alternative payments, capital markets activity, and AI agents. As Lemmens notes, "Penetration of fintech players into traditional finance segments and growth of revenues and profits of leading fintechs have met expectations in the eight years since we launched the Robeco FinTech strategy in 2017".

MAS Opens New Frontiers

Singapore's regulatory environment is evolving to support thematic investing opportunities. In March 2025, MAS proposed a groundbreaking Long-term Investment Fund (LIF) framework that would allow retail investors access to private market investments—including private equity, private credit, and infrastructure—for the first time.

This development is particularly significant given that alternative AUM in Singapore grew 14% in 2024, led by private equity, venture capital, and hedge funds. Private credit investments specifically rose by 21% year-on-year, indicating robust institutional appetite that may soon extend to sophisticated retail investors.

The proposed framework offers two structures: Direct Funds that make direct private market investments for greater asset visibility, and Long-term Investment Fund-of-Funds (LIFF) structures that invest in other private market funds, leveraging professional expertise in fund selection and monitoring.

Sector-Specific Momentum: Where the Smart Money Goes

The sectoral distribution of thematic investment flows reveals telling patterns. Healthcare innovation, digitalisation, and environmental themes dominate allocations, reflecting both demographic imperatives and technological disruption.

In healthcare, demographic tailwinds are particularly compelling. Singapore's ageing population creates sustained demand for medical innovation, whilst technological convergence—from genomics to medical devices—offers multiple investment vectors. As Robeco's healthcare strategy notes, "The sector is expected to sustain solid growth as gaming technology advances, mobile gaming expands, and the popularity of esports and streaming platforms continues to rise globally."

Technology themes remain equally attractive. Daniel Ernst, Portfolio Manager at Robeco's Digital Innovations strategy, observes that "AI development is not slowing down" and predicts that "AI agents are poised to shift from merely answering questions to taking action, as the technology seeks to fulfil its productivity enhancing promise."

The Contrarian Case: Risks and Realities

Despite the compelling narrative, thematic investing carries inherent risks that sophisticated investors must navigate. StashAway acknowledges that themes "come with higher volatility" and require "patience, and the ability to handle short-term ups and downs."

The platform advocates a "core and satellite" approach, where thematic portfolios complement rather than replace diversified holdings. This framework allows investors to "invest in the themes you believe in, while maintaining the stability of a portfolio of core assets."

Concentration risk represents another challenge. Many thematic strategies exhibit high correlations during market stress, potentially negating diversification benefits when they're most needed. The removal of genomics exposure from healthcare themes due to "high correlation with biotechnology" illustrates how careful risk management remains essential.

Looking Forward:

Singapore's economic projections for 2025 provide a supportive backdrop for thematic strategies. DBS forecasts 2.8% GDP growth, driven by sectors including electronics, trade-related services, finance, and information and communications technology—all areas where thematic strategies maintain significant exposure.

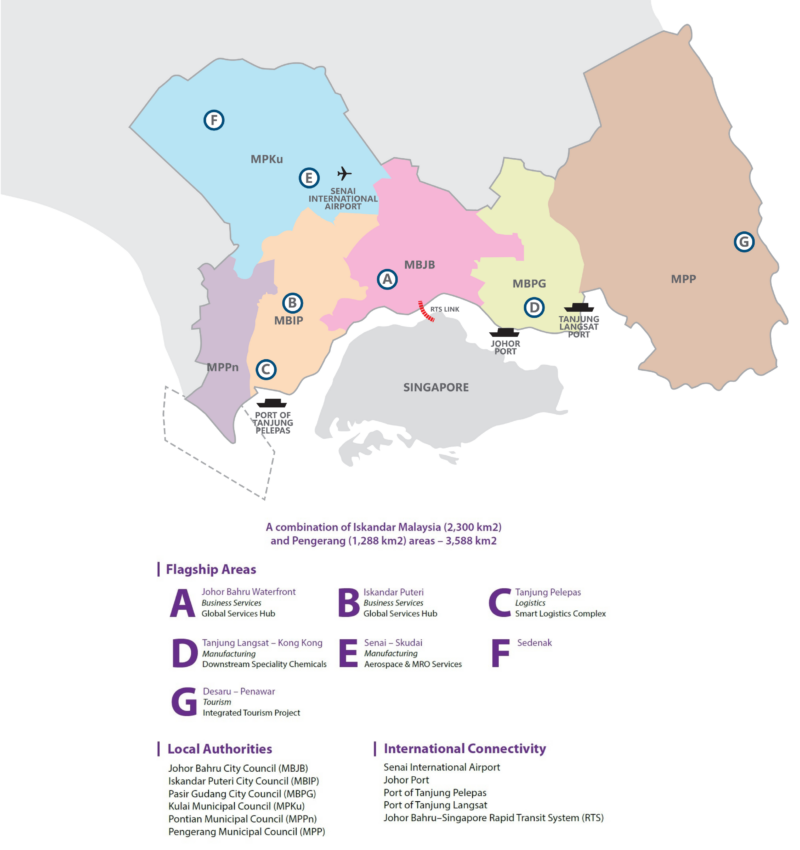

The forthcoming Johor-Singapore Special Economic Zone (JS-SEZ) represents another thematic opportunity. Covering 3,571 square kilometres in southern Johor, the zone promises to benefit industries including data centres, electronics, renewable energy, and tourism. The completion of the Johor Bahru-Singapore Rapid Transit System Link by end-2026 will further enhance connectivity and investment flows.

Image source: Malaysia Investment Development Authority (MIDA)

Evolution, Not Revolution

For Singapore's sophisticated investor base, thematic investing represents an evolution rather than revolution in portfolio construction. The approach offers compelling opportunities to capture structural changes whilst requiring disciplined risk management and realistic return expectations.

The combination of Singapore's regulatory support, global connectivity, and demographic advantages creates an environment where thematic strategies can flourish. However, success ultimately depends on careful theme selection, diversification discipline, and the patience to allow long-term trends to unfold.

As Singapore's AUM continues its upward trajectory toward potential new records, thematic investing appears positioned to capture an increasing share of sophisticated investor allocations. The question isn't whether this trend will continue, but rather which themes will prove most prescient in capturing the structural changes reshaping our economic future.

For high-earning professionals and business owners, the message is clear: thematic investing offers a sophisticated tool for positioning capital ahead of transformative trends. The key lies in wielding this tool with the precision and discipline that characterises Singapore's best investment practices.

Let us know what you think about this topic, and what do you want to hear next.

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

Sources and References:

- Monetary Authority of Singapore Asset Management Survey 2024

- United Nations Development Programme - ESG Investing in Asia Report 2024

- DBS Singapore Market Outlook 2025

- Robeco Investment Insights 2025

- StashAway Thematic Portfolio Refresh

- MAS Retail Private Market Investment Framework

-3.png?width=50&name=Square%20(2)-3.png)

Let us know what you think of this post