Singapore REITs’ Resurgence: Logistics Leads as Deal Flow Returns

TL;DR

- Singapore REITs (S-REITs) are regaining momentum after two cautious years, with fresh fundraising and portfolio activity returning—especially in logistics.

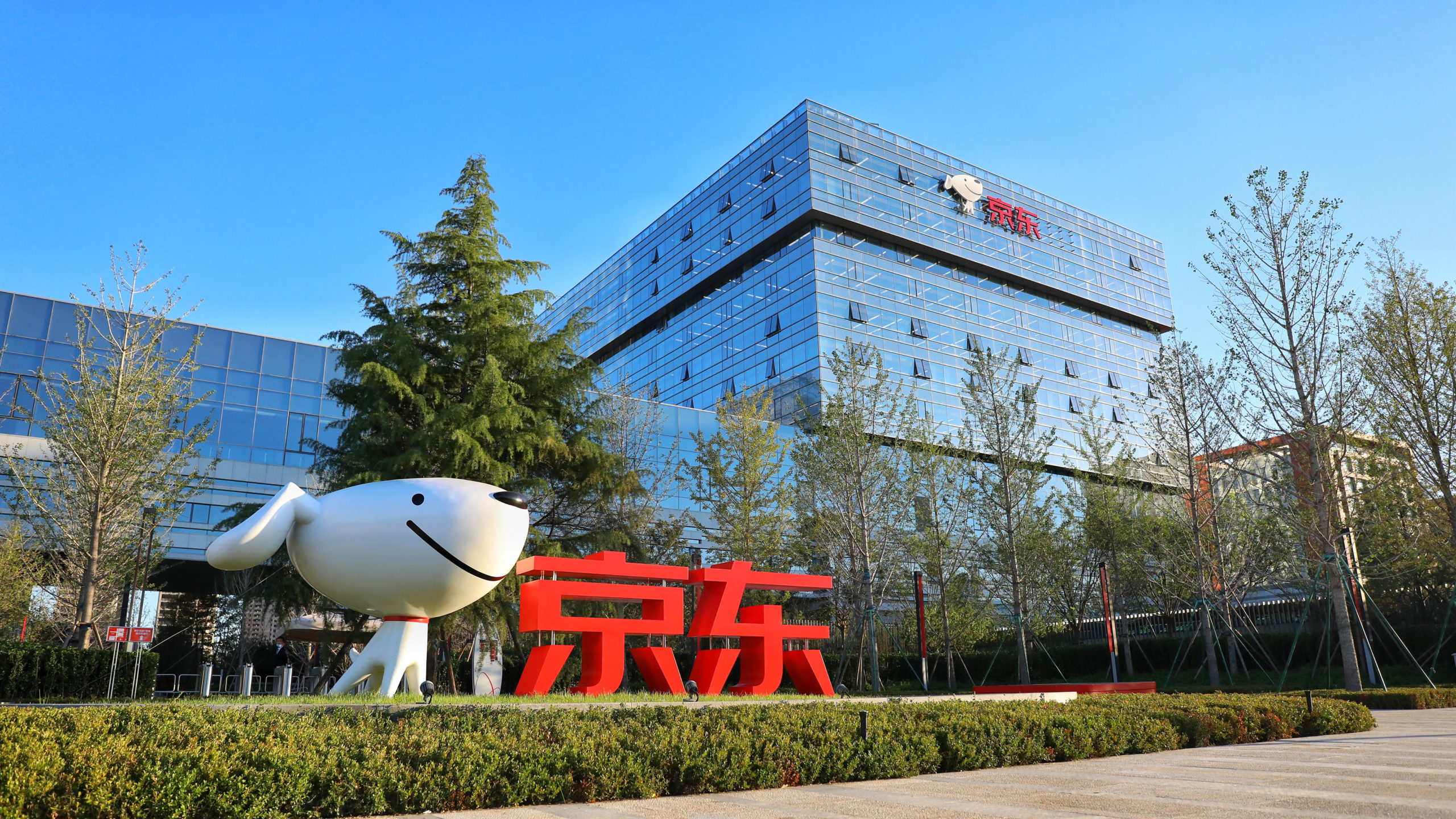

- AIMS APAC REIT’s S$56.65 million Aljunied Avenue site acquisition and JD.com’s plan—alongside Partners Group and EZA Hill Property—to launch a $1 billion (≈S$1.35 billion, est.)

- Singapore REIT seeded with logistics assets acquired from CapitaLand Ascendas REIT (CLAR) point to renewed confidence under stabilising rates and resilient rental growth.

- For Singapore investors, the opportunity set is improving, but selectivity (balance sheet strength, cost of debt, and tenant quality) remains critical.

Why S-REITs Are Stirring Again

After a challenging 2022–2023 marked by rising funding costs and discounted equity valuations, several green shoots have emerged:

-

Stabilising interest rate backdrop: As the rate cycle peaks, earnings visibility improves and equity/debt windows begin to reopen.

-

Rental resilience in logistics/industrial: Supply-chain normalisation and e-commerce demand continue to support Singapore logistics rents.

-

Selective portfolio repositioning: Managers are recycling into higher-yielding or future-ready assets, often in logistics and data-adjacent segments.

Two fresh developments capture this momentum:

-

AIMS APAC REIT (AAREIT) acquired a S$56.65 million site at Aljunied Avenue, extending its industrial footprint.

-

JD.com, with Partners Group and EZA Hill Property, plans to launch a $1 billion Singapore-listed REIT focused on logistics properties acquired from CapitaLand Ascendas REIT (CLAR). (Assuming “$” = USD; ≈S$1.35b using 1 USD = 1.35 SGD for illustration.)

These moves suggest: (1) a reopening in capital formation (new listings, seed portfolios), and (2) continued investor preference for logistics’ cash flow durability and tenant stickiness.

The 2–3 Year Trend at a Glance (2023–2025)

Scope note: Table anchors on events and sector-level patterns visible through mid-2024; values reflect disclosed figures or clearly labelled estimates.

| Year | Development | Segment | Size / Value | Signal for Investors |

|---|---|---|---|---|

| 2023 | Gradual normalisation after rate shocks; selective divestments and capex deferrals | Cross-sector | n/a | Managers preserved balance sheets; focus on core geographies and resilient tenants |

| 2024 | Rental resilience in SG logistics/industrial; cautious reopen of equity/debt markets | Logistics/Industrial | n/a | Underwriting stabilises; funding windows begin to thaw |

| 2025 | AIMS APAC REIT buys Aljunied Ave site | Industrial (SG) | S$56.65m | Targeted growth with brownfield/AEI potential to lift NOI |

| 2025 | JD.com + Partners Group + EZA Hill to launch Singapore REIT seeded with CLAR logistics assets | Logistics (SG) | $1.0b (~S$1.35b est.) | Fresh IPO pipeline; logistics remains the cornerstone for new capital formation |

AEI = Asset Enhancement Initiatives; NOI = Net Operating Income.

What’s Driving the Comeback?

- Rates: From headwind to manageable crosswind

While higher-for-longer still compresses spreads, the rate peak reduces earnings volatility. Managers with staggered debt maturities and active hedging can re-open growth pathways (AEIs, selective buys) without over-levering.

- Logistics and industrial outperformance

Singapore logistics vacancies remain tight by historical standards, with e-commerce, pharma, and third-party logistics underpinning rents. The JD.com vehicle aligns with this demand stack—tech-enabled logistics with strong tenant covenants tends to command stable occupancy and steady escalations.

- Portfolio pruning and capital recycling

Expect more sell small / buy scalable moves: trimming non-core or low-growth assets, then redeploying into income-accretive logistics or data-ecosystem assets (e.g., last-mile, cold chain, power-ready industrial).

Case Study: AAREIT and JD.com’s Logistics Push

-

AAREIT’s S$56.65m Aljunied Avenue site suggests confidence in value-add potential—either through redevelopment intensity, modern specifications, or consolidation with adjacent plots. For unitholders, the lens is execution: time-to-income, AEI capex discipline, and eventual rent reversion.

-

JD.com’s planned ~$1b REIT (with Partners Group and EZA Hill Property) seeded by assets acquired from CLAR signals a healthy primary market: willing sponsors, institutional co-backers, and proven seed assets. For investors, the watch-list includes: sponsor pipeline visibility, WALE by gross rental income, leverage upon listing, and hedging policy.

What It Means for Investors

Opportunities

-

Total return normalisation: If funding costs recede at the margin, distribution yields plus operational growth (rents, AEIs) can rebuild mid-single-digit to high-single-digit total returns for quality names.

-

Logistics overweight: New listings and acquisitions continue to cluster here; selectivity around tenant credit and lease structures (e.g., CPI-linked escalations) can compound defensively.

-

IPO pipeline re-opening: Fresh paper—like JD.com’s vehicle—can reset comps and catalyse secondary re-ratings for peers with similar quality.

Risks

-

Refinancing cliffs: 2025–2026 refis still matter; spreads may stay sticky even as base rates ease.

-

Valuation discipline: Chasing growth at narrow cap-rate spreads can dilute accretion; insist on clear AEI IRR and leasing visibility.

-

FX/portfolio complexity (for diversified names): Cross-border assets add FX and policy risk; hedging effectiveness is key.

Investor Checklist

-

Cost of debt & hedging: % fixed, average all-in cost, and maturity ladder.

-

Organic growth: Embedded rent reversions, AEI pipeline, downtime assumptions.

-

Sponsor strength: Access to pipeline, governance track record, and alignment.

-

Logistics quality: Location, specs (clear height, floor loading, power), and tenant mix.

-

Pro-forma metrics (for IPOs): WALE, leverage, ICR, payout policy, and acquisition right-of-first-refusal (ROFR) scope.

FAQs

- Is JD.com’s planned $1b Singapore REIT USD or SGD?

The report references $1 billion without currency marker. We assume USD and provide an SGD estimate (~S$1.35b at 1.35 FX) for orientation. Confirm final currency in the prospectus. - Why focus on logistics now?

Logistics offers rent resilience, high occupancy, and e-commerce-linked demand, making it a natural focus for new capital in a still-elevated rate world. - Will distributions (DPU) recover broadly?

Selectively. Expect balance-sheet-strong, logistics-tilted names to recover faster. Broad-based DPU growth still depends on the pace of funding cost relief and successful AEI execution. - Is this a good time to buy S-REITs?

For long-term investors, dollar-cost averaging into quality with strong sponsors, prudent leverage, and clear growth runways is a sensible approach. Avoid stretched payout ratios and weak hedging.

Let us know what you think about this topic, and what do you want to hear next.

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

Sources referenced:

- The Financial Express — China tech giant JD.com unit, two other firms plan $1 billion Singapore REIT (user-provided link).

- AIMS APAC REIT — Company announcements and investor materials (for the S$56.65m Aljunied Avenue acquisition; verify against the latest SGX filing).

- MAS — Monetary Policy Statements (context on inflation and policy stance up to mid-2024).

-3.png?width=50&name=Square%20(2)-3.png)

-2.png?height=200&name=2024%20website%20assets%20(1)-2.png)

Let us know what you think of this post