Silver Frenzy Hits Singapore: Why Dealers Can't Keep Up With Surging Demand

Physical silver has become one of the hottest—and hardest to find—commodities in Singapore, as a historic global price surge has sent investors rushing to bullion dealers and left retailers scrambling for stock. Waitlists now stretch months into 2026, with some refineries refusing to take new orders as the precious metal experiences its most dramatic rally in modern history.

The Singapore Scramble

Local bullion dealers are witnessing unprecedented demand. At Metal & Picks in Upper Boon Keng, sales of gold and silver jumped nearly sixfold from November to December 2025 as customers rushed to secure purchases amid soaring prices. Owner Kwek Seow Bin told Channel NewsAsia that nine in 10 customers now opt for silver over gold, despite its greater volatility.

"For us dealers, we are not doing a lot of marketing. People are searching for us to buy physical metals," said Kwek, who has been forced to raise profit margins and place larger orders to cope with demand.

The supply crunch is severe. When Metal & Picks ordered approximately 300 pieces of 1kg silver bars in December, they were told the stock wouldn't arrive until March 2026—a sharp slowdown from the usual one-to-two-week delivery timeframe. Some refineries have stopped accepting orders entirely, leaving dealers on indefinite waitlists.

The buyer demographic has shifted dramatically. Once dominated by middle-aged local customers, heartland shops now see buyers in their 20s and even foreigners hunting for physical silver as larger dealers run out of stock. This reflects a broader democratization of precious metals investing, with younger investors seeking alternative assets amid economic uncertainty.

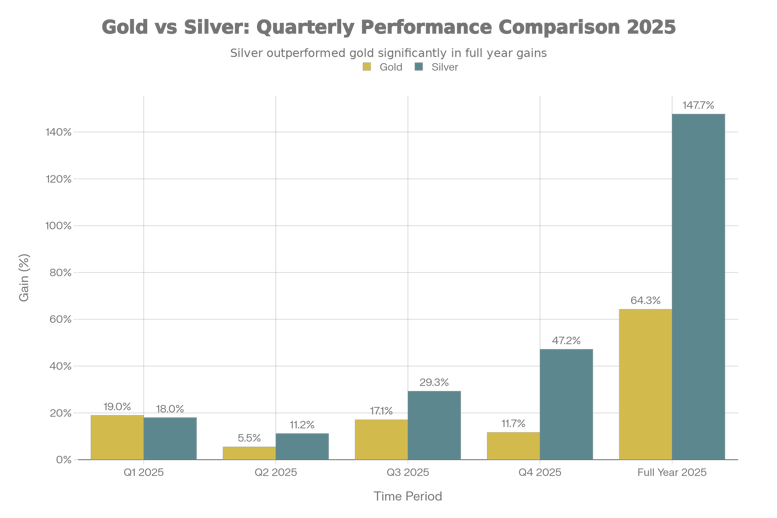

Historic Performance: Silver's 147% Surge

The scramble in Singapore mirrors a global phenomenon driven by silver's extraordinary 2025 performance. The white metal surged 147% during the year, opening at $28.87 per ounce on January 1 and closing at $71.63 on December 31. Silver reached an all-time intraday peak of $83.62 on December 28 before experiencing sharp volatility, including a 9% single-day decline—its sharpest drop since August 2020.

As of January 8, 2026, silver trades around $78.67 per ounce, already up 9.8% year-to-date. This dramatically outpaces gold, which rose 64% in 2025 (from $2,624 to $4,315) and currently trades near $4,472, up just 3.6% in 2026.

The gold-silver ratio—a key metric measuring relative value—compressed from 91:1 at the start of 2025 to approximately 57:1 by early January 2026. This represents one of the sharpest compressions in decades, signaling that silver has been appreciating at more than double gold's rate.

The Perfect Storm: Supply Deficits Meet Industrial Demand

Silver's exceptional performance stems from a fundamental supply-demand imbalance with no parallel in the gold market. The silver market is experiencing its sixth consecutive year of structural deficit, with 2025 shortfalls ranging between 95-149 million ounces. Cumulative deficits from 2021-2025 approach 800 million ounces—equivalent to nearly an entire year of global production.

Total silver demand reached approximately 1.148 billion ounces in 2025, while supply totaled only 1.030 billion ounces. Mine production has stagnated at roughly 813-835 million ounces annually, with recycling contributing another 150 million ounces. This persistent shortfall has systematically depleted above-ground inventories, creating the physical tightness now visible in Singapore's retail market.

What makes silver unique is its dual identity as both a precious metal and critical industrial commodity. Industrial applications account for 59% of silver consumption, compared to gold's minimal industrial usage. Solar photovoltaic manufacturing alone consumed over 25% of annual global silver supply in 2025, with demand continuing to surge as global solar capacity expands. Beyond solar, silver demand accelerated across electric vehicles, data centers, 5G infrastructure, and semiconductor manufacturing—all sectors experiencing secular growth rather than cyclical fluctuations.

"There is an over-demand situation," said Dr Tan Kee Wee, an economist at the Singapore Precious Metals Exchange. "For the past five years, the mines have not been able to come out with enough silver to meet the demand for the industrial side."

This creates unique market dynamics. Unlike cyclical commodities where demand destruction typically occurs at elevated prices, silver's green energy applications represent structural demand shifts with limited substitution potential. "For industrialists, they don't care—they need the silver," Dr Tan explained. "They'll pay more because otherwise their factories will be short of silver and stop running."

Macro Tailwinds Amplify the Rally

Beyond supply fundamentals, silver benefited from synchronised macroeconomic catalysts throughout 2025. The Federal Reserve's three rate cuts created ideal conditions for non-yielding precious metals by reducing opportunity costs. A weakening U.S. dollar—down over 6% in 2025—made metals cheaper for holders of other currencies.

Global silver ETF inflows surged to 95 million ounces by mid-2025, already surpassing total inflows for all of 2024. Geopolitical tensions, including U.S.-China trade frictions and Middle East instability, triggered additional safe-haven demand. China's announcement of silver export restrictions beginning January 1, 2026—requiring businesses to apply for export licenses—added fuel to the rally and intensified supply concerns.

What This Means for Consumers

While silver's surge has strained retail supply, economists say the consumer impact will remain limited. Silver represents only a small fraction of total manufacturing costs for products like electric vehicles, solar panels, and semiconductors. "While silver prices may have gone to record highs, the actual effect on the output price of a solar panel is not very significant, given everything else in play," said Ang Yuit, president of the Association of Small and Medium Enterprises.

For investors seeking physical silver exposure, however, the message is clear: expect to join waitlists, pay substantial premiums, or turn to digital platforms as dealers expand online sales channels to meet demand. The physical silver shortage in Singapore reflects a global repricing of the metal from cyclical commodity to strategic asset—a structural shift that shows no signs of reversing as industrial electrification accelerates into 2026.

Data sources: Channel NewsAsia, StatMuse, BullionVault, Silver Institute, Trading Economics, CNBC, HSBC Research, Investing.com

This is an AI-powered article, curated by The Financial Coconut.

Let us know what you think about this topic, and what do you want to hear next.

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

-3.png?width=50&name=Square%20(2)-3.png)

Let us know what you think of this post