The Moody's Reckoning: How America's Credit Downgrade is Reshaping Global Investment Landscapes

When Moody's stripped the United States of its pristine AAA credit rating on 16 May, dropping it one notch to AA1, it wasn't just another administrative adjustment by a ratings agency—it was a seismic shift that has reverberated through global markets with particular implications for Singapore investors and the broader Asian financial ecosystem.

The downgrade marked the end of an era. For the first time since 1949, Moody's had lowered Washington's credit score, making it the final major ratings agency to abandon faith in America's fiscal trajectory. With S&P having cut the US rating in 2011 and Fitch following suit in 2023, America has now officially lost its AAA status across all three major rating agencies—a symbolic blow to a nation that has long served as the world's financial anchor.

The Anatomy of America's Fiscal Crisis

The numbers behind Moody's decision paint a sobering picture of American fiscal reality. The agency cited the nation's staggering $36 trillion debt pile and warned that "successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs."

Perhaps most alarming is the debt servicing burden: a whopping 16% of US tax revenues—approximately $684 billion—were consumed by debt interest payments this year alone. For context, Germany's equivalent figure sits at just 4%. Moody's projects this will deteriorate further, with "federal interest payments likely to absorb around 30% of revenue by 2035, up from about 18% in 2024."

The agency expects the federal deficit to widen dramatically, reaching nearly 9% of GDP by 2035, up from 6.4% in 2024. Meanwhile, the debt-to-GDP ratio is projected to balloon to 134% by 2035, compared with 98% in 2024—levels not seen since the post-World War II era.

View of the past downgrade by S&P, Fitch, and now Moody's:

Singapore's Market Response

Singapore's immediate reaction provided an early glimpse of global sentiment. The Straits Times Index closed lower on the first trading day following the downgrade, weighed down by concerns over US fiscal stability. This wasn't merely sympathy selling—it reflected the interconnected nature of modern finance, where American fiscal health directly impacts global liquidity and risk appetite.

For Singapore investors, the implications extend beyond market volatility. As a major financial hub with significant exposure to US assets—both directly through Treasury holdings and indirectly through multinational corporations—Singapore finds itself particularly sensitive to shifts in American creditworthiness.

OCBC's analysts noted that whilst they "remain bullish on investment outlook despite US credit downgrade," the ratings change nonetheless "challenges portfolio allocations." This measured response reflects the pragmatic approach many Singapore-based institutions are taking: acknowledging the significance whilst avoiding panic.

Market Reactions: The Week That Tested Nerves

The immediate market response revealed both the gravity of the situation and the resilience built into global financial systems. Initially, 10-year Treasury yields spiked to 4.51% on Monday morning, whilst the dollar weakened against major currencies. Gold rallied almost 1% to $3,220 an ounce as investors sought safe havens, though it subsequently retreated.

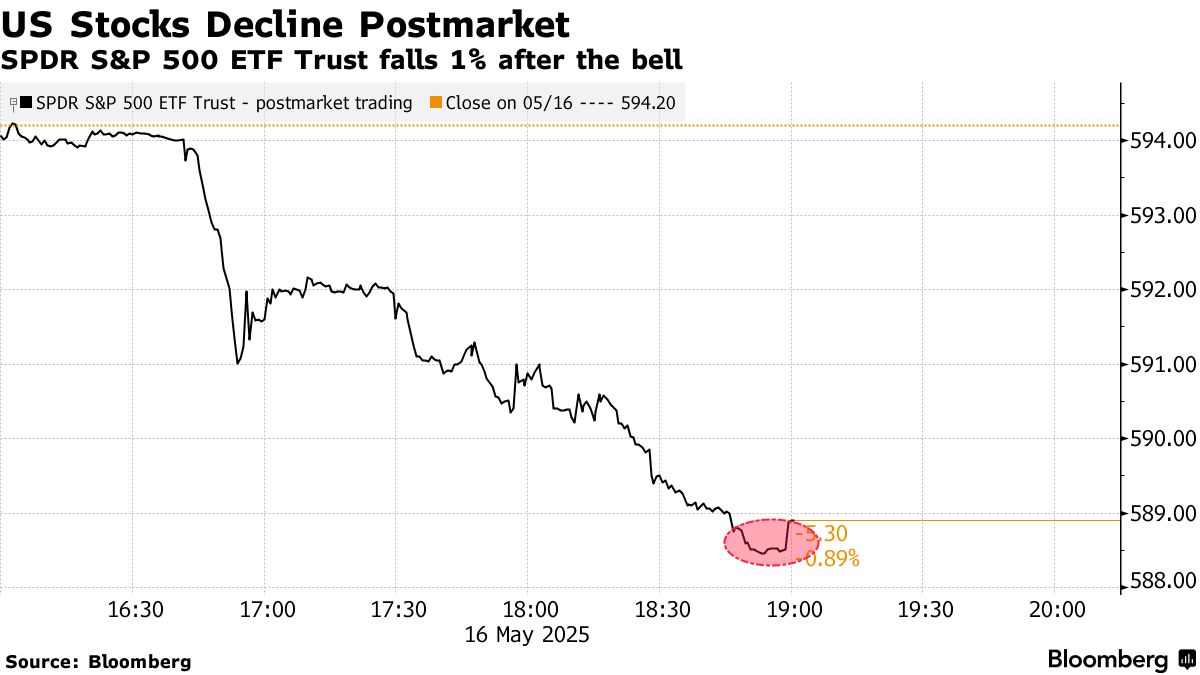

However, contrary to some predictions of widespread panic, US equity markets demonstrated remarkable stability. By Monday's close, the Dow had actually gained 0.32%, the S&P 500 rose 0.09%, and the Nasdaq climbed 0.02%. As NBC News reported: "Investors largely shrugged off a downgrade of the U.S.' credit rating in Monday trading, as stocks ended the day mostly flat."

This relatively muted response suggests markets had already priced in much of the fiscal concern. As Capital Economics analysts noted: "The downgrade itself doesn't seem so far to have made much of a market splash."

The Ripple Effects: Who Felt the Tremors

Whilst equity markets remained surprisingly stable, certain sectors felt more pronounced impacts. Mortgage markets experienced immediate stress, with 30-year fixed rates hitting 7.04% on Monday—the highest level since April. This demonstrates how sovereign credit concerns translate directly into borrowing costs for consumers.

Currency markets told a more complex story. The dollar's decline against major currencies wasn't purely negative sentiment—it also reflected rebalancing as investors diversified away from dollar-denominated assets. The British pound rose to $1.35, its highest level against the greenback since early May.

Asian markets showed mixed reactions. Japan's Nikkei dropped 0.66%, Australia's ASX 200 declined 0.46%, and Hong Kong's Hang Seng slid 0.56%. These moves reflected concerns about global risk appetite rather than direct exposure to US fiscal issues.

Long-term Implications: Beyond the Headlines

The Moody's downgrade carries implications that extend far beyond immediate market movements. For Singapore investors, several strategic considerations emerge:

Portfolio Diversification Imperatives: The downgrade reinforces the importance of geographic and currency diversification. Singapore's position as a gateway to Asian markets becomes increasingly valuable as investors seek alternatives to US-centric portfolios.

Interest Rate Environment: Rising US Treasury yields create both challenges and opportunities. Whilst they increase borrowing costs globally, they also offer more attractive returns for fixed-income investors willing to accept the marginally higher credit risk.

Reserve Currency Dynamics: Perhaps most significantly, the downgrade chips away at the dollar's hegemonic status. ECB President Christine Lagarde noted that the dollar's recent decline "reflects the uncertainty and loss of confidence in US policies among certain segments of the financial markets."

Weatherproofing Your Portfolio: Practical Strategies

For Singapore investors navigating this new reality, several defensive strategies merit consideration:

1. Diversified Fixed Income: Rather than abandoning US Treasuries entirely, consider ladder strategies that balance yield capture with duration risk. Singapore Government Securities and high-grade Asian corporate bonds offer regional alternatives.

2. Currency Hedging: Given dollar volatility, Singapore-based investors with significant US exposure should evaluate currency hedging strategies. The Singapore dollar's relative stability makes it an attractive base currency for hedged international investments.

3. Alternative Safe Havens: Traditional safe havens like gold have already responded positively to the downgrade. However, investors might also consider Swiss francs, Japanese yen, or even certain cryptocurrency allocations as portfolio insurance.

4. Asian Equity Focus: Singapore's role as an Asian financial hub positions local investors advantageously for the ongoing shift towards regional markets. Consider increasing allocations to ASEAN markets and China A-shares.

The Nuances Mainstream Media Missed

Several subtleties deserve attention beyond headline coverage:

Regulatory Arbitrage: Interestingly, from a mechanical perspective, the downgrade changes very little for institutional investors. Basel III capital requirements don't differentiate between AAA and AA1 ratings, meaning banks won't face forced selling. This technical detail helps explain the muted institutional response.

Political Retaliation Risk: History suggests Moody's may face political retribution. Following S&P's 2011 downgrade, the Justice Department launched investigations, and CEO Deven Sharma subsequently left the company. Current Moody's management faces similar risks under the Trump administration.

Debt Ceiling Dynamics: The downgrade comes as Congress debates extending Trump's 2017 tax cuts, which could add $3.8 trillion to the deficit over the next decade. This creates a dangerous feedback loop where fiscal stimulus necessitates more borrowing, potentially triggering further downgrades.

Foreign Holdings Stability: Despite trade tensions, March data showed foreign demand for US Treasuries remained robust. China's reduction in Treasury holdings appeared more about duration management than wholesale exit from dollar assets.

What Lies Ahead: Navigating Uncharted Waters

Looking forward, several scenarios could unfold. In the optimistic case, US economic growth outpaces debt accumulation, gradually improving fiscal metrics. However, Moody's projections suggest this is unlikely without significant policy changes.

More concerning is the potential for a "bear steepener spiral," where rising yields increase debt servicing costs, forcing even more borrowing and creating a vicious cycle. As Franklin Templeton's Max Gokhman warned: "Debt servicing costs will continue creeping higher as large investors, both sovereign and institutional, start gradually swapping Treasuries for other safe haven assets."

For Singapore, this environment presents both risks and opportunities. As a well-managed financial centre with strong institutions and prudent fiscal policies, Singapore could benefit from capital flows seeking stability and diversification away from US assets.

The Moody's downgrade represents more than just a ratings change—it's a recalibration of global financial relationships that have underpinned markets for decades. For Singapore investors, adapting to this new reality requires balancing pragmatic risk management with strategic positioning for a potentially less dollar-centric future.

The immediate market response suggests panic is unwarranted, but complacency would be equally dangerous. As Mike Goosay from Principal Asset Management warned: "In the short run, the U.S. is still the world's reserve currency and store of wealth. But the bigger issue is long-term. If global investors start to question the U.S. role in the global order, that's when we could see real consequences."

For Singapore's sophisticated investor base, the challenge lies in navigating this transition whilst maintaining the diversified, globally-oriented approach that has served the city-state so well. The Moody's downgrade may prove to be less about American decline and more about the maturation of a multipolar financial world—one where Singapore's strategic position becomes increasingly valuable.

Disclaimer for The Financial Coconut:

The Financial Coconut is a financial education platform dedicated to empowering individuals with simplified insights into money, investing, and personal finance. By engaging with our content—including articles, podcasts, videos, or social media—you acknowledge that none of the information provided constitutes financial, investment, tax, or professional advice of any kind. Our content is designed strictly for educational and informational purposes.

Your financial journey is unique, and while we aim to make complex topics digestible, we strongly encourage you to consult licensed professionals (financial advisors, accountants, legal experts, etc.) before making decisions that impact your wealth, career, or lifestyle. Past performance of investments discussed is not indicative of future results, and all investments carry risks, including the potential loss of capital.

The Financial Coconut, its creators, and contributors are not liable for any actions taken based on our content. Remember: We’re here to spark curiosity and share knowledge, but you own the choices you make. When in doubt, seek a pro!

Stay savvy,

The Financial Coconut Team

Let us know what you think about this topic, and what do you want to hear next.

You can now be our community contributor and make a pitch to have your favourite personality be on our show.

Join our community group and drop us your insights on this topic.

-3.png?width=50&name=Square%20(2)-3.png)

Let us know what you think of this post